B2B Churn 101: Know Thy Churn

This series of articles on Churn explores its significance, structure, and mitigation approaches in the new era of SaaS.

In the previous article in the Churn 101 series, we explored the significance of churn, especially for B2B products, and especially in today's era of AI-enhanced and AI-native solutions, and why it's not always systematically addressed.

Today, I want to discuss how to understand churn to draw the right conclusions and form a relevant action plan.

When your house burns down, you see the destruction, but the real problem might be a costruction problems, or constant safety violations. Churn works the same way — customer cancellations are what you see, but the underlying causes require deeper investigation.

But first:

Churn ≠ Retention

Churn and retention are inverse metrics, like two sides of the same coin.

At the same time, there's a nuanced distinction worth making:

Retention is a more operational metric for product development and may serve as a (somewhat) leading indicator of success.

It is a behavioral metric that represents regular value consumption in alignment with the customer problem occurence frequency (daily, weekly, monthly). You can track retention across different timelines, e.g. 1-month retention, 3-month, 6-month, and so on — this data gives you granular insight into customer engagement, depicting and somewhat predicting their value consumption.

Churn is backward-looking and more strategic — it's about where you lose customers and their money.

It's measured by billing cycles (monthly, quarterly, annually) and represents customer’s reluctance to pay for the product, not use it per se.

So while churn is essentially the opposite of retention, they measure slightly different things. It's like comparing oranges to… grapefruits, perhaps? 🤔

Three Types of Churn in B2B

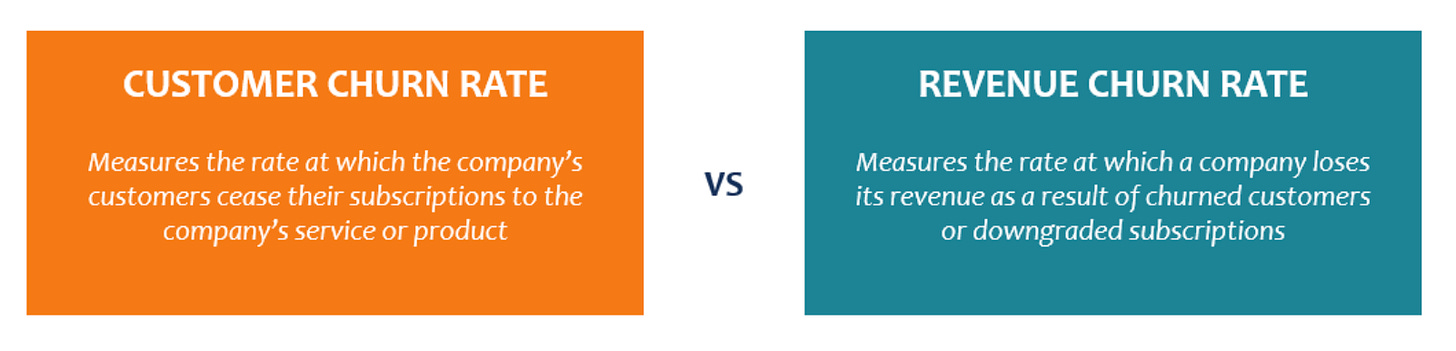

Customer (or account) churn: The entire company (can be a “logo” or its division) cancels their paid usage. This is the most common variation and what we typically refer to when saying "churn."

Revenue churn: This is a contraction of your product's revenue, not customer base size. Consider two scenarios:

The customer doesn't churn and continues as a paid customer, but downgrades to a lower plan.

One of your highest-ACV accounts decides to leave. They may constitute as little as 0.5% of total annual customer churn, yet their annual revenue contribution may represent 20% of the company's total revenue! While your customer churn rate may look impressive, your business is bleeding.

This reflects the nature of B2B products where revenue isn't evenly distributed among customers.

Track both customer and revenue churn at all times, and compare the trends. This will help you understand where your value delivery is falling short and what type of intervention is needed:

Many small customers churning? Likely issues with Product-Market Fit and/or poor self-serve adoption pathways.

Few large customers churning? Likely feature gaps or massive shifts.

For the rest of this article, I'll mostly focus on customer churn. Still, let’s also note

User churn: When individual user accounts within the customer account are deleted. This may happen for various reasons and isn't necessarily catastrophic. But a persistent trend in the account size contraction can be an indicator of upcoming account churn.

Team expansion or contraction dynamics are important components of the account health, and are factored in the “at-risk” or PQA qualification systems.

P.S. Some people also use the term usage churn, but I personally prefer to say “decline in engagement”, or “inactivity”, or “dormancy”, to avoid further confusion.

P.P.S. We relate the term “churn” to paying customers, or at least to activated freemium customers. When we refer to users who are not active and haven’t even reached the Aha! moment, we should call them what they are — unactivated users, and not factor them into churn , retention, or engagement analysis. This may sound obvious, but in reality I constantly see this confusion happening.

Do You Have a Churn Problem?

Having churn doesn't necessarily mean you actually have a problem with it. I know it's confusing, but let me explain.

Consider Your Product Lifecycle Stage

This is something I rarely see discussed, but it often confuses founders. Here's how I think about it.

Early-stage startups typically have low churn: they have mostly customers who are either not paying or paying little, very short feedback loops and tight relationships, and customers often get features they request. What's not to like? But it doesn’t yet mean you have a strong Product-Market Fit, only that your natural churn problems haven’t even started yet.

Middle-stage: As the product builds up and gains traction, it becomes less and less customized. The product roadmap now relies not on anecdotal data and feature requests from early customers, but on aggregate usage data, market signals, and feedback from the entire customer base. It now becomes more “average” to fit their needs. Early customers may feel it doesn’t fit their need as it used to, close relationships weaken, and their requests are no longer priorities. They start leaving. It’s natural evolution, expect it.

Late stage: With growing traction the product inevitably attracts non-target audiences. The product grows, and so does the variance and experimentation in positioning and messaging to attract growth from the target segment and test adjacent ones. Churn starts becoming higher and happens more often in earlier terms of the customer lifecycle. 10-20% annual churn often becomes the norm.

This is the time to start gathering proper churn data and analyze its nature, and launch the first “low-hanging fruits” churn prevention initiatives.

Scaling PMF: This is time to hit gas on growth, optimize many product surface areas and course-correct the strategy. With these plans product can manage to lower churn to sensible numbers (below) and keep it at bay.

Mature companies often experience PMF erosion due to market or technology shifts, or competitive threats, and may see increased churn rates again, especially if they expand into new products/markets and start the whole PMF cycle again.

Not All Churn Deserves Your Attention

Don't leave your churn unsegmented!

Care for your ICP first. You may notice that your ICP churn isn't as high compared to total customer churn — that's a great sign!

Building everything for everyone is the fastest path to slow death. Many companies say they have multiple ICPs, but even linguistically this doesn't make sense — there's a reason it's called “ideal”! It is a segment with the highest chance of success with your product, that “stays, pays, and prays for your product”.

I get it, sometimes defining a single ICP can be challenging despite best intentions, especially for very horizontal products. But that doesn't mean there should be multiple ICPs. There can be audiences that exhibit similar characteristics to ICP, but are different in others. You can mark them as “Lookalikes”, “ICP-ish” or whatever you want.

ICP isn't just a qualitative profile — it's defined with data! Data shows you which customers purchase fastest with least pain for everyone, engage best, grow fast, refer your product, etc. Yes, before you have enough data, you'll operate on qualitative assumptions. But by the time you actually need to systematically address churn, you must have data that tells you who your ICP is.

In the majority of cases, churn is an indication of value or positioning problems. And it is the very reason to have an ICP — to build and deliver value that relates to and resonates with someone, not everyone.

Then explore “lookalikes” if you like, but don’t invest into non-ICPs — it's a waste of time and effort. They'll come, try, and leave no matter what. Let them be. Double down on your strengths instead of chasing every single weakness.

Track When Churn Happens

In its simplest form, you need to understand the ratio of first-term churn (customer churns before their first renewal) vs. later cycles.

Benchmarks say that 25% or less churn rate for first-term renewal is normal. This doesn't mean you should ignore your first-term churn, but understand that it's not the end of the world. Most likely, it signals problems in your positioning, GTM, perhaps targeting, and maybe activation inefficiencies.

Later-term churn patterns reveal entirely different problems, mostly associated with either objective factors (e.g., macroeconomics) or delivering insufficient value to your ICP over time.

How Much Churn is Bad?

As we enter the benchmarks zone, mind that they should be supporting, not primary evidence. I mean, we don't even have a repeatable PMF playbook for startups because each is unique in market, customers, and problems. So why would benchmarks be universal?

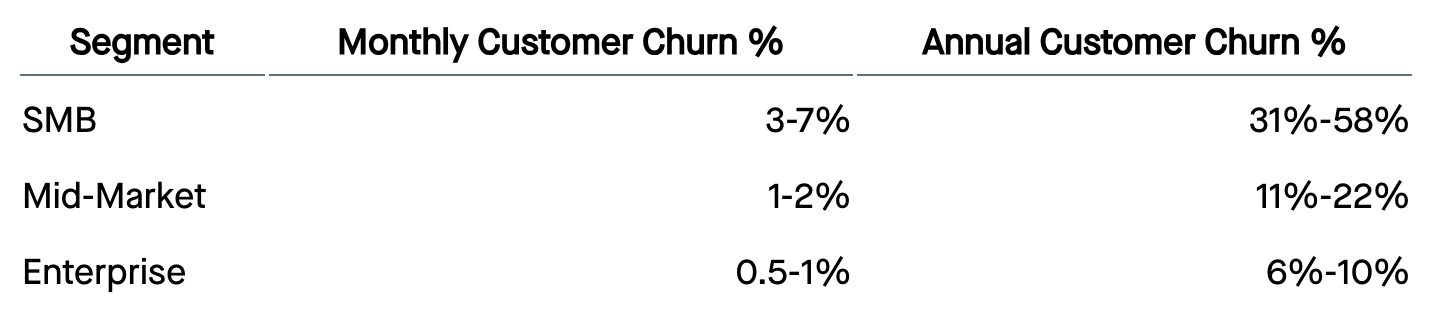

Here's a famous benchmarks comparison from Lenny:

But mind two things:

This is aggregate average data, which can differ significantly by domains/industries. Even “enterprise” segment has very different players.

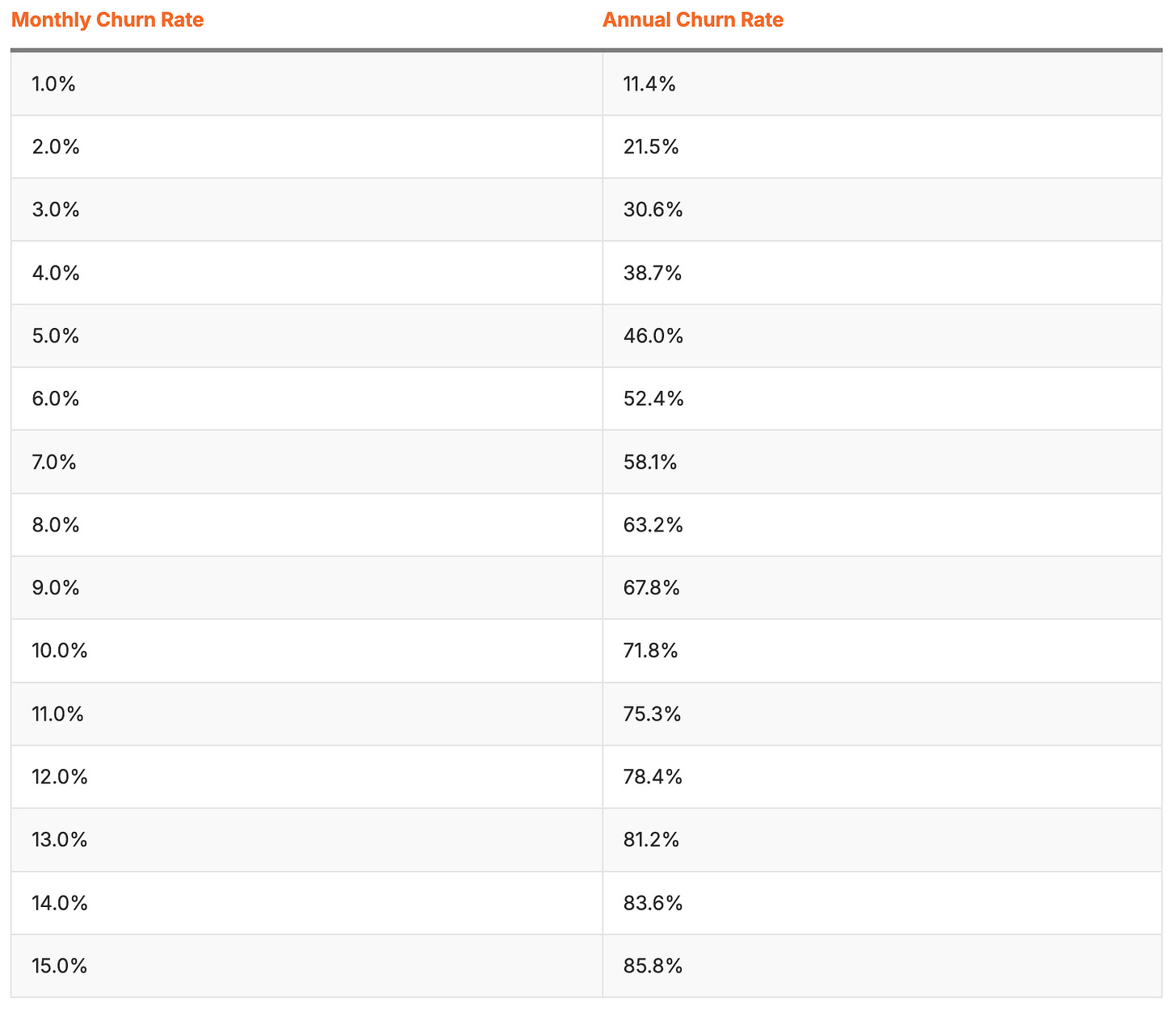

This is monthly churn rates benchmarks. It’s easy to get tricked by seemingly small numbers. But monthly churn compounds into sometimes staggering annual churn rates of 50%+ of the entire customer base!!!

How to convert Monthly churn rate into Annual churn rate:

ANNUAL CHURN RATE = 1 - (1-MONTHLY CHURN RATE)¹²

or, for your convenience:

So a rather "innocent" 4% monthly churn rate, if unaddressed, can result in a 38.7% annual churn rate!

Here are average B2B SaaS industry benchmarks from Tom Tunguz:

Three Churn Reason Categories

At a high level, I categorize churn reasons into three main buckets:

Value Problems: Churn is the “silent feedback” from unsatisfied customers

Objective Factors: Churn is a consequence of macro or micro environment

Leaks: Churn happens because of product experience or purchasing gaps

Your biggest portion of meaningful churn will likely be the first one. But let's examine the other two buckets first.

"Objective" Churn

Churn isn't only, always, or entirely about you and your product.

There are also:

Macro reasons: Worsening overall economic climate, new laws or regulations, industry or technology shifts. There's a high chance you already know about this. And you need to adjust!

Example: I joined UXCam in 2022, at the onset of economic recession. At the time, the product positioning was heavily skewed toward behavioral analytics targeting primarily UX designers. BEcause of this, when companies started to revise their toolstack to save costs, UXCam turned out to be a non-mission-critical software.

We understood that quickly, added a few features, and repositioned the product as an analytics suite for mobile apps, offering behavioral, product, and issues analytics for entire cross-functional mobile teams (=> mission-critical!)

Micro reasons: Other times, companies go out of business, downsize, or pivot drastically. Even vice versa - they can grow so fast that they simply outgrow your solution 🤷♀️

You can’ do much about it at the moment, but it’s always a good idea to support good communication to stay on top-of-mind for them if their need re-emerges, or even to foster viral potential (the customer may actually like your product but not need it, and they can recommend it).

The "Leaks": Where Customers Fall Through The Cracks

These are cases when your customers actually think that your product is valuable, but something prevents them from paying for it.

Payment Failures (aka Involuntary Churn)

Card expiration or blockage, transaction failures due to bank new regulations, insufficient funds, any kind of payment errors, and so on. The customer may not even know about this!

Make sure your billing system is set up to make further attempts, and notify your teams so that they proactively contact the account admin (in-app, email, even phone) to alert them about the issue.

Naturally, the chance of payment data becoming invalid is higher in annual subscriptions and can constitute as much as 40% of all renewal cancellations!

Low Pricing Optionality

Micro-factors can cause a need to downgrade. But if the price jumps between plans are too large, they create artificial churn cliffs: budget-conscious customers may downgrade to free plan or churn entirely because they can't find acceptable middle ground between what they want to use and what they should pay for. Remember, one of the 5 core Jobs-to-be-Done of your pricing model is to engage customers: if they don't use what they pay for, they won't keep paying for it 🤷♀️

Wrong Value Metric

The reverse is also true — the higher the engagement with the product, the more customers should have to pay. And your value metric should be aligned with the growing product consumption. Otherwise, you can expect some of your customers to “hack the system”, resulting in revenue churn. For example:

You may charge per seat, but customers can use the “shared email” hack to downgrade their subscription. Rule of thumb: is your product doesn’t offer personalized value to each user in the client account - pick another metric.

If you charge per workspace or project, they can game your system and move all their work into one workspace: their usage won’t decline, but their ARPC will!

I’m not saying one value metric is better than another. It should only be relevant and fair — not only for your users, but also for your business.

Understanding Why Churn Happens

Now that you know who churns, when, and where, it's time to understand why.

First, you need to understand, what kind of churn do you have (value problems, objective factors, leaks), how much of each, and their ratio.

Churn Surveys

During cancellation, you should ask customers for a reason. If you don't yet — this should be your first initiative on the "Fight Churn" action list.

Churn survey questions are usually variations of:

It's too expensive

I don't need it anymore

I'm not using it enough

I found another solution

The product needs improvements

Missing features

Not sure how to use it

+ offer (but don’t force) a text field for them to provide explanation.

You should use these questions to your advantage. For example, you can add answers like “Poor customer support” if it makes sense for you. Or, provide more granular “improvements” reasons, like “Technical issues” and/or “Usability issues”.

The point is not in the precise set of answers, but to understand on a high level whether churn is out of your control, or within it.

The survey won’t give you precise answers, but it will tell you where to look. For example, if the majority of answers are "It's too expensive", then it’s time to pay attention to your pricing model — understand your customers’ willingness to pay, revise value metrics, plans structure, etc.

A few notes here:

Align your survey data with data on high-ACV clients churn that sits with your Account or Customer Success Managers. You need to have a single source of churn truth that can be segmented by customer size, ARPC, tenure, etc.

Churn surveys don’t give insight into downgrades (revenue churn). That’s a different investigation, often performed on a customer-by-customer basis.

You can use various retention techniques in the cancellation process, such as offering time-limited discounts or downgrades, offering to pause subscriptions, increasing FOMO with loss aversion, or suggesting they talk to Customer Support. Read more about such tactics in Aakash’s Anticonversions Guide.

Talk to Customers

You didn't think you could avoid this, did you? Well, you were right.

But you can't talk to everyone, so you need to pick your battles. My suggestion is to form hypotheses via churn data & survey, then talk to relevant churned customers to get qualitative insights on their circumstances, motivations, and reasoning to enrich, refine, or reject your hypotheses.

Focus on recently churned ICP customers who used the product for a reasonable time period first. Then, if needed, go backwars in time or expand into the “lookalikes”. Just don’t forget to segment your insights.

Feedback Loops from "High-Touch" Sources

Establish clear communication channels with Sales, Customer Success, and Account Managers. Ask them to document every high-value churn with detailed context — these customers represent not just significant revenue, but also ample learning opportunities, especially in the ICP segment.

Analyze First-Term Churn

This is a more advanced analysis and requires all the data foundations. Do this after you’ve dealt with later-term churn, of if your first-term churn is significant.

Remember the “25%” benchmark for the First-term churn? While these numbers are normal, they still represent customer potential or can give insights into your development and go-to-market strategy.

There are a few high-level reasons for this:

Your activation process is subpar and didn’t manage to create stong habit loops in real life (that can be truly hard in complex B2B products, and many teams try to “hack” their numbers by changing the definition of Aha and Habit moments to something more convenient…)

Your onboarding is okay, but with further engagement customers realize the product value is insufficient in relation to the price tag.

Or your product doesn’t deliver on the promise altogether: its positioning is misaligned with real value, and/or messaging is targeted at a non-relevant segments. It’s not always clear right away and may take time for the customer to discover.

To understand who is who, first look at their profiling data and filter out everyone who isn't your ICP.

Then examine their engagement patterns and where/when in the journey they go inactive — the closer churn happens to the renewal date, the more likely they haven’t found sufficient value in your product. Early cancellation indicates potential onboarding problems or mistargeting. And don't forget to compare this with cancellation reasons from their churn survey to see patterns.

Preventing Churn Proactively

We’ll talk churn management strategies in the next post, but I still want to suggest a few tactics to deal with symptoms and keep your hand on the pulse.

Close Every Involuntary Leak

Implement comprehensive payment retry logic, proactive card update campaigns, and multi-channel failure communication. These are the easiest churn prevention wins — pure operational improvements that directly impact the bottom line.

Subscription Cancellation Options

For prosumers or SMBs, consider offering to pause subscriptions for seasonal or temporary reduced needs. Better to retain the customer relationship than force complete cancellation.

Offer temporary discounts or free months if they pick the “It’s too expensive” reason.

Induce FOMO by showing what they are going to lose

All of those have worked on me personally, and more than once :)

According to the pricing guru Patrick Campbell, such preventive measures can lower your cancellations by 10%-25%!

Push Annual Subscriptions

Offer substantial discounts or free months for annual payments in your pricing plan, but also gently nudge your multi-month customers to opt into annual subscriptions. This isn't about postponing the inevitable — annual subscribers indeed tend to stay longer, as churning now becomes friction in itself for them.

At-Risk Scoring System

Create a qualification system to rank each account. Include characteristics like account size changes (i.e., consistent reduction in seats), engagement decline trends, support tickets and conversations, technical problems, and renewal date proximity. Use these signals for targeted intervention like personal outreach, engagement campaigns, or temporary discounts.

In the next article of the B2B Churn 101 series, we'll discuss strategic churn improvements, such as product engagement, innovation, differentiation, pricing, organizational alignment, and even aesthetics. Stay tuned :)