B2B Churn 101: The Cost of Churn

This series of articles on Churn explores its significance, structure, and mitigation approaches in the new era of SaaS.

If I have any philosophy about growth, one core pillar of it is that SaaS should shift from an Acquisition-first towards a Retention-first mindset.

Of course, it’s not some divine revelation to say that retention matters a lot, that it’s king, that churn is a silent killer. But few act on this. It becomes just a word with a negative connotation.

Why churn is rarely deliberately addressed?

80% of founders and leaders I talk to, while concerned about churn, tend to steer growth conversations elsewhere, because tackling churn feels like a massive undertaking, without a straightforward path, requiring investment (financial, focus, time, cognitive tax), and often with unclear ROI.

I've observed three common reasons why churn tends to be left to chance:

1. Lack of awareness

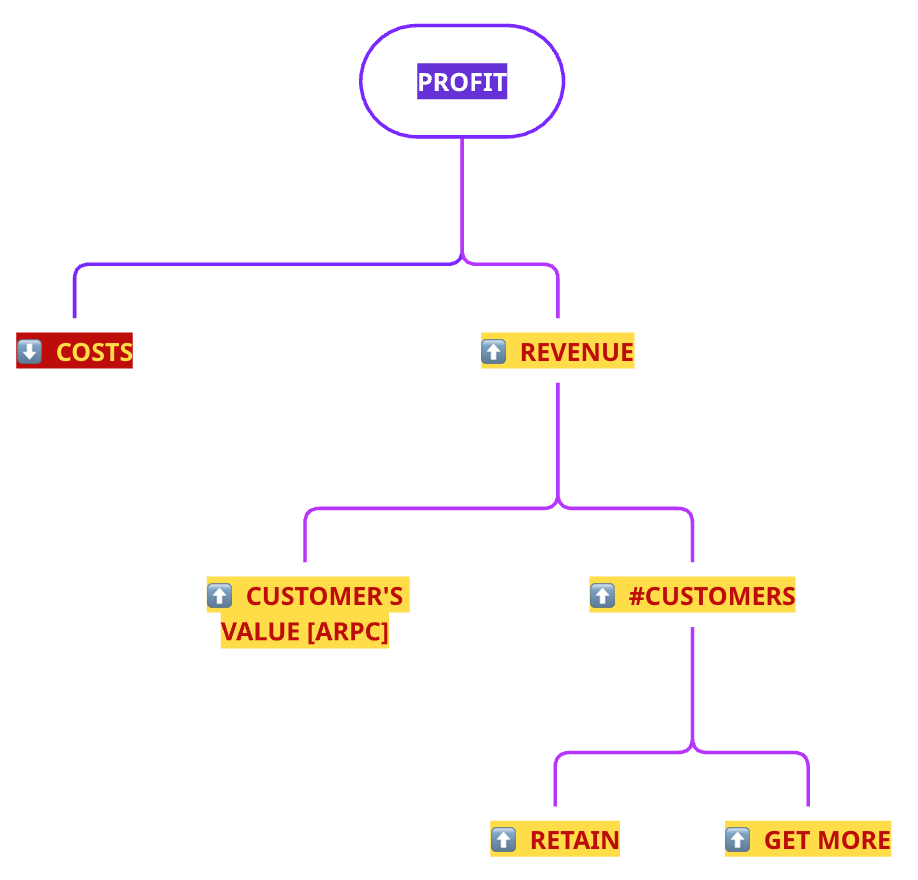

In Unpacking B2B Product Growth I showed growth as a high-level system of levers:

This reveals three main levers for B2B revenue growth:

Grow the customer base and get new revenue (Acquisition).

Retain existing customers to prevent revenue loss (Retention).

Expand existing customer value by selling more to them (Expansion).

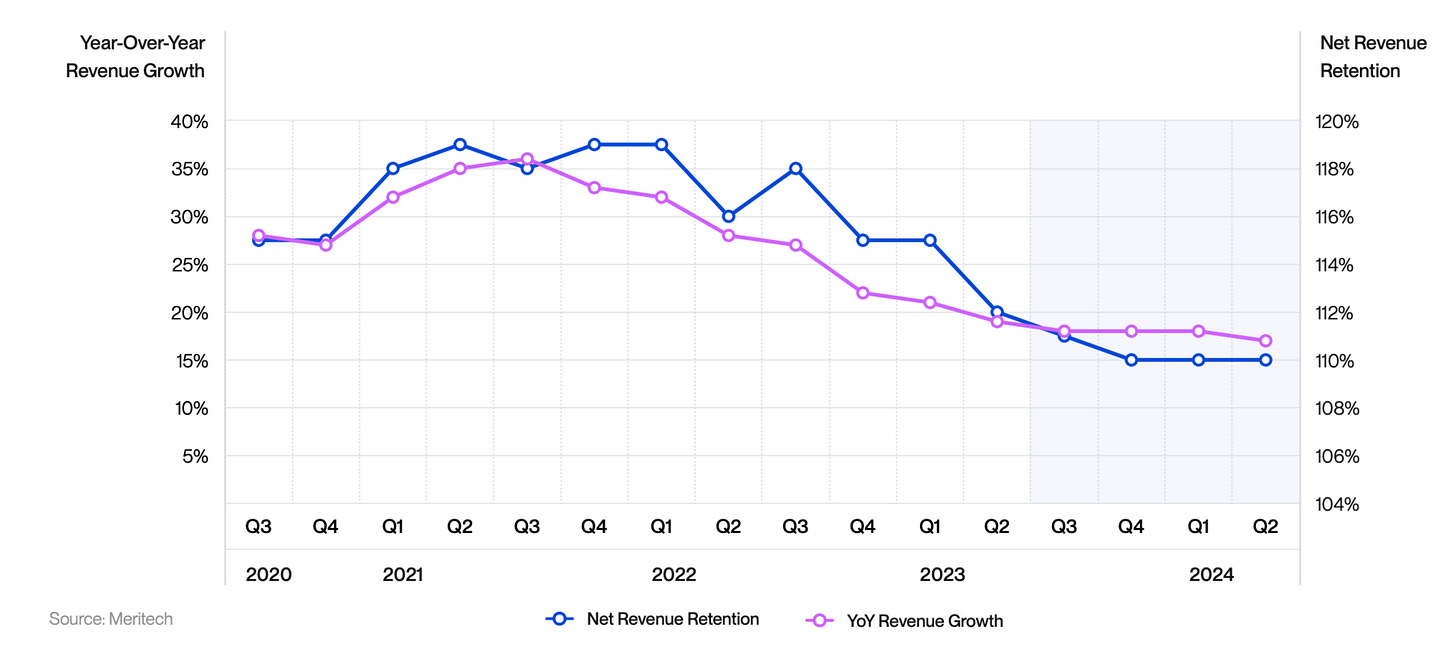

Revenue from retained customers compounds year over year, and as a business matures, a larger share of total revenue should come from these customers. This is why with time churn starts to matter more.

Conversely, even a small decrease in churn can yield massive revenue uplifts. Bain & Company research highlights that a 5% increase in customer retention can boost profits by 25% to 95%. So even 1% gain can help a lot.

Customer vs. Revenue churn

A key characteristic of B2B businesses is that their customer base can vary significantly in ARPC, leading to uneven revenue distribution. At a previous company, 12% of our customers generated over 60% of ARR. It’s common. Now imagine if one of them churns. Your customer churn rate might still look impressive, but your annual revenue would suffer serious blood loss.

Or, say, your customers stay, but more and more downgrade to cheaper plans, perhaps due to an economic recession. This is also revenue churn, even if customer retention remains intact.

So at all times you need to track and correlate both.

…

While Sales and Customer Success teams somewhat manage revenue churn, customer churn largely remains unaddressed holistically and consistently.

It's not that customer churn consequences are hard to grasp, but their impact often doesn't resonate with SaaS startup founders and leaders (I quite arbitrarily consider startups as companies below the $10M ARR mark).

Partly due to complacency, as some churn is simply unavoidable.

Partly because these effects are delayed. In our uncertain times, many can't afford to think in terms of 1+ year initiative timelines.

Mostly? In my personal opinion, it is because of the collective addiction to the acquisition-first growth mindset.

2. Acquisition-first mindset

Maybe it's just me and I’m in my own bubble, but most SaaS growth conversations I encounter are about acquisition. Growth is equated to a #leads problem. While I appreciate its importance, especially for early-stage startups, this mindset is dangerous both for individual companies and the industry as a whole.

Of course, improving marketing channels, sales pipeline and conversion is important for B2B. It’s just that pouring tons of acquisition money into a leaky bucket of churn doesn’t make much sense. But I see it all the time…

And… getting new customers feels good. We love new stuff! It brings freshness and, even better, hope. We don't like fixing old stuff, especially when fixes bring unglamorous decimal percentage improvements on delayed timelines.

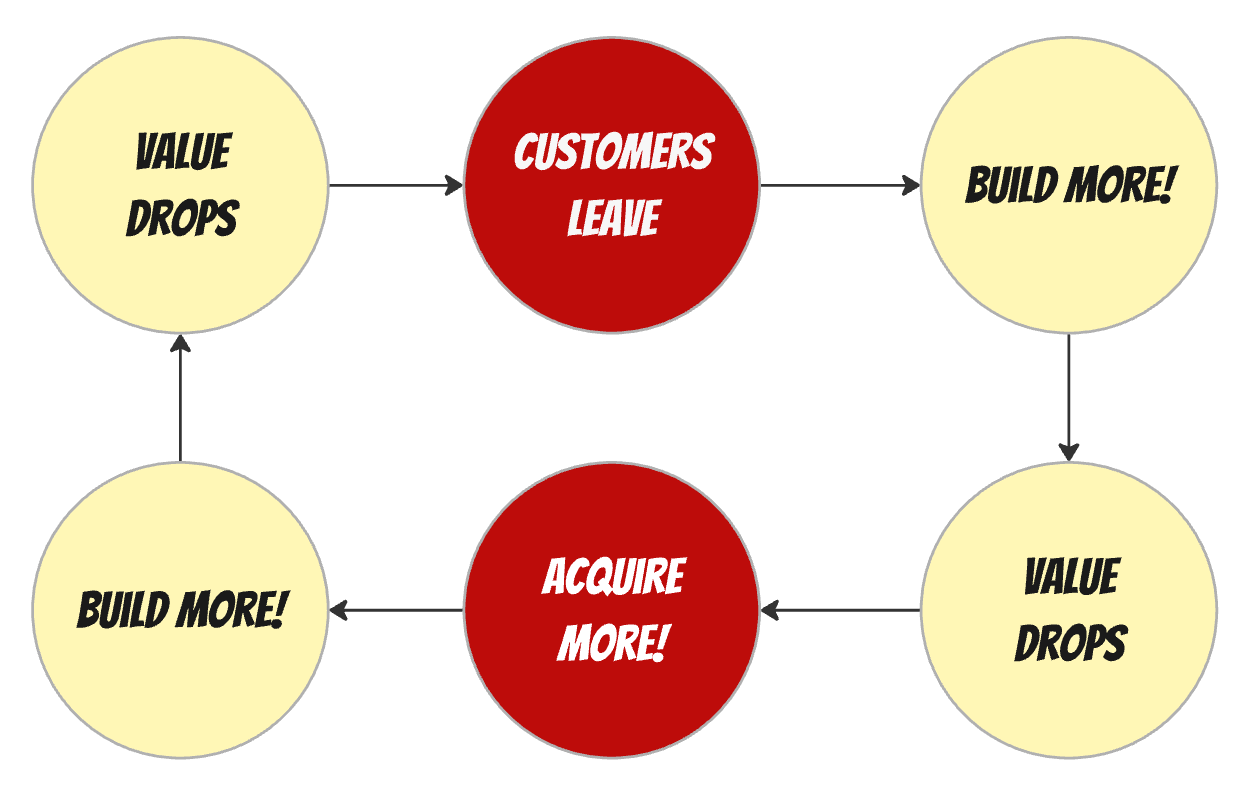

I call this viscious cycle The Acquisition Trap, and it goes like this:

Customers are leaving.

Product teams hustle to build more features, hoping they will magically solve churn, or/and create custom features for specific customers, disrupting existing plans.

Product becomes a "patchwork blanket" of half-baked MVPs; value proposition gets diluted.

Other customers notice the lack of innovation, irrelevant features, and awkward UX, and leave.

Acquisition teams now compensate for losses, but acquiring and selling becomes harder as value prop and ICP become unclear.

Marketing expands their focus into adjacent segments without product alignment, and Sales aggressively closes leads.

Product prioritizes features for prospects and customizes for new customers. Innovation stops. Product Value prop and brand continues to diminish.

More pressure on Acquisition… and the cycle repeats until the company runs out of money.

This is the danger of the acquisition-first mindset, and it's real. I don't know if it can or needs to be fought; perhaps market punishment is enough. The only question is when it will reach its culmination. I think soon.

3. No Playbook

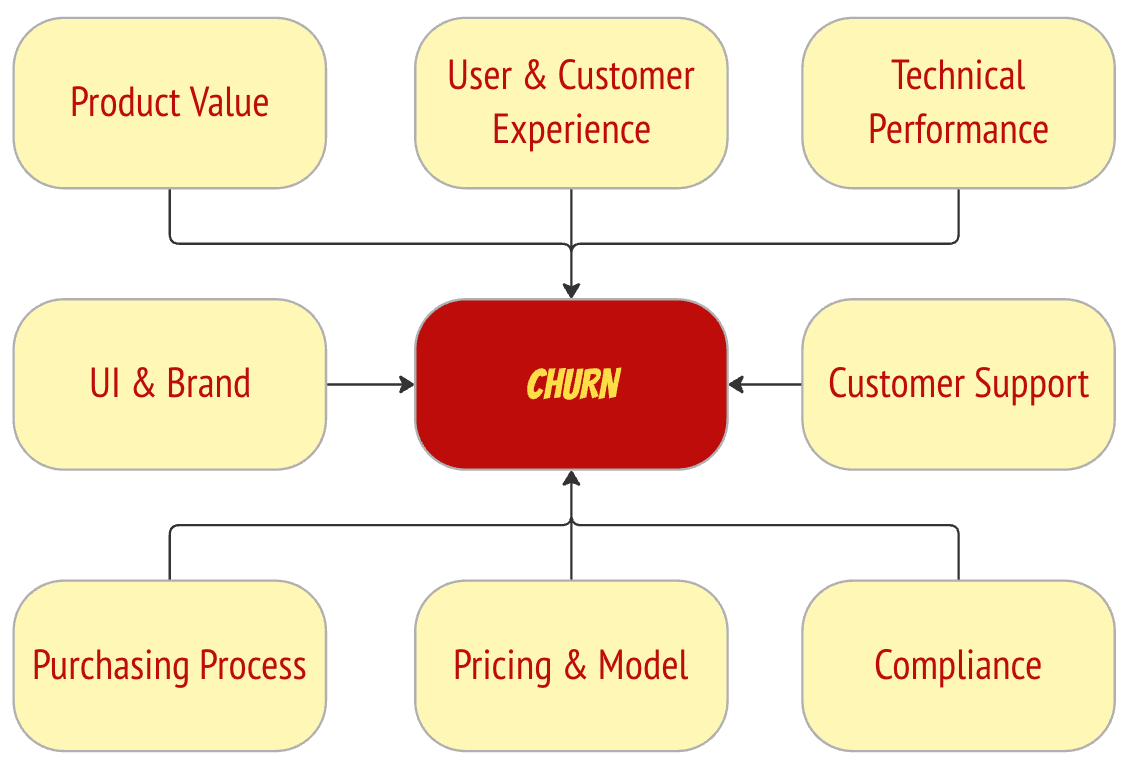

Churn manifests in various ways, each originating from multiple underlying causes. In a way, churn is the (unsaid) customer feedback for your product.

Solving churn is not a framework, and there are no silver bullets and templated solutions. It’s a methodology that requires robust understanding and tracking.

Churn is an outcome of a myriad of interconected reasons. Your team needs to deeply understand why it happens. It’s a lot of work.

To track and improve it, there has to be a detailed Churn Driver Tree, and PMs are collectively still not great at it as, as connecting and correlating low-level customer behavior signals with retention is hard and confusing.

Because of churn being a high-level outcome metric, correlating specific initiative results with overall retention can be tricky, so motivation (or honesty) can go out of the window.

Churn is a lagging indicator. It’s not easy to see and compare results from initiatives on the annual timelines (typical for B2B). Proxies help, but you still can’t always be sure of the aggregate effect.

User onboarding and time-to-value has its peak moment, and its great! It’s truly a high-leverage and high-priority tactic. But it’s not enough. And if the company maintains an acquisition-first mindset, even great onboarding will lose to churn inertia.

It requires some company maturity to invest into robust planning and tracking systems. The unlucky flip side is that the later a company tries to fix churn, the more costly, overwhelming, and less effective the endeavor becomes.

Bonus: Unclear ownership

Churn should be everyone's problem:

Marketing should bring relevant leads.

Sales should focus on ICPs.

Product should builds features that drive adoption and engagement.

Growth should effectivelly and seamlessly connect users and customer to value (via a free model, activation, pricing, engagement strategies).

Design should optimize for intuitive and clear UX.

Engineering should builds technically performing, scalable products, and fast.

Customer Success should enable users and anticipate and triangulate problems.

But when everyone’s responsible, in real life it often means that no one is, if there is no unified company strategy and objectives to adress churn.

Why today retention is more important than ever?

In 3 Seismic Shifts in Product Management I wrote:

Today, a business can launch and validate faster than ever with as little as one person. Competition is intense, and growth is getting harder and more expensive, while willingness-to-pay is lowering due to the economic climate. Strengthening engagement and retention is not optional anymore — it's a question of survival.

Let me explain.

We now have a lower barrier to market entry, so many new, small, niche products have emerged, often built by a single person. So, increased competition. But how likely are these new apps to become B2B users? Not very. They can create their own solutions for their own smaller problems. Thus, the share of B2B customers remains roughly the same, while competition grows.

So, Alex, isn't this an acquisition problem?

Well, it is, especially if you’re earlier stage, certainly.

But the thing is, that for companies with existing customers and revenue, acquisition becomes a symptom for failed retention. They are leaking customers and revenue and try to offset this loss with new revenue.

Problem is, in the acquisition-first mindset, new revenue is perceived to be the main solution for growth. And it operates on a weird assumption that there’s some magical pool where customers just spawn, and you just need to find a new tactic to 'fish them out.' Erm, no such magical pool exists. Most customers are taken. Switching solutions costs money, time, brainpower, and organizational effort.

They leave in two cases:

They've found a better solution for a similar price.

They've found a similar or better solution for a better price.

The first case is something we in the SaaS industry have learned to work with.

Now, we're increasingly facing the second situation: a swarm of new competitors. They may be imperfect, but they're specialized and precise (because in this competitive market you must niche down to win) and offer a better price. It may not necessarily be cheap, but their pricing structure clearly correlates with product value, its scaling, and the customer's long-term willingness to pay.

Importantly, the betterness of the solution*price combo is subjective. Customers leave $500/month SaaS solutions for $20/month ChatGPT. It might not be necessarily better or easier or as streamlined, but it's okay for the price. And for another $20/month with n8n, they can close most painful workflow gaps.

In many ways, people simply don't need generic SaaS solutions anymore when anyone can build anything for their specific problem with a little time.

What this means is:

If your solution leaks customers and revenue, you're at exponentially increasing risk of losing to cheap and imperfect indirect competitors. Better leads and processes won't save you much (though they might make you feel better for a short while🕺).

Your acquisition fishing rod is only necessary to catch ready-to-switch customers at the right moment IF you're certain you won't lose them. Otherwise, you'll fall into The Acquisition Trap.

Today, customers expect far more value per dollar spent on a product than before. And they have a choice. So even good products with polished UX and performing funnels are at risk.

When your product delivers outstanding perceived value for a meaningful price, has a great user experience, and in-product mechanisms that prevent the leaks, your acquisition will no longer be a major concern by design.

In the next part of the Churn 101 series, I'll discuss how to identify and size churn correctly, and learn why it happens, to create meaningful opportunities for improvement.