5 Jobs-to-be-Done of Your Pricing Model

Your pricing isn't just a business asset. It's a value-delivery system for your customers that has 5 essential jobs.

I like to say that a pricing model is a reflection of a company’s growth strategy. But on deeper, more hidden layers, it also mirrors their entire business philosophy, customer knowledge, organizational health, and cross-functional collaboration 😄.

Pricing model is one of the most significant growth levers for a business, but it also impacts Product-Market Fit, Go-to-Market Fit, scaling and innovation. But too often I see functional leaders or founders looking at it from just one angle: "Are we charging the right amount?"

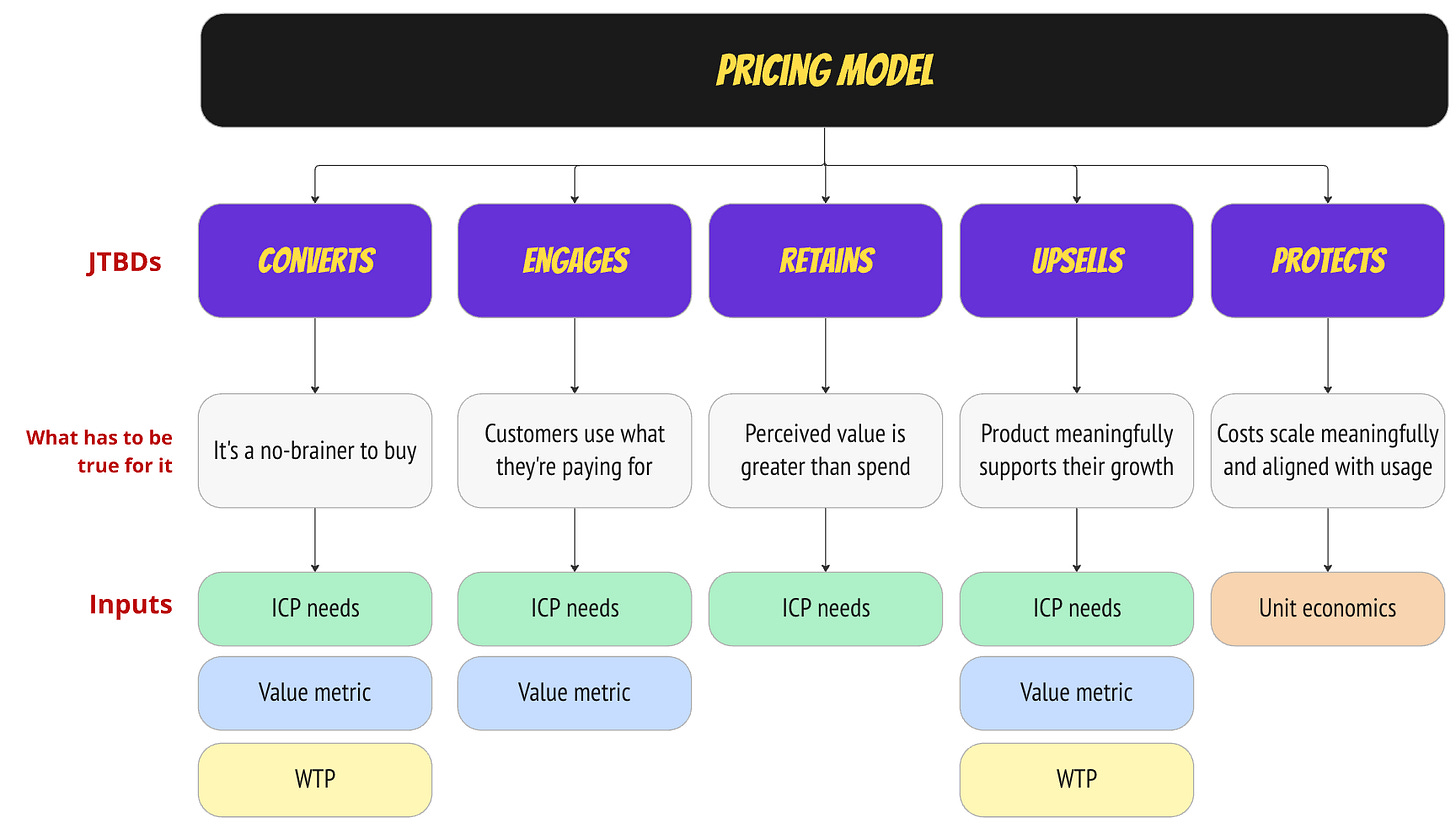

Pricing model jobs-to-be-done (JTBD) concept is my idea to show that the model influences the entire growth strategy, and highlight key elements to be truly understood in order to build a meaningful, scalable, and bullet-proof pricing system.

But before we dive in, I also want to emphasize that pricing model should focus on long-term revenue. It’s a system where each element needs to play well with others, as they’re all working towards the same goal: sustainable long-term growth. And if you are in a situation where you have to prioritize short-term revenue for a while, use tactical adjustments like time-bound promotions or efficiency optimization. Don’t take it out on your pricing model — it’s not easy to build in the first place, and it’s even harder to change in many organizations without unintended consequences for customer trust, internal operations, or long-term value.

5 Jobs-to-be-Done

Let’s go through each job-to-be-done and explore it.

JTBD #1: Convert

It's hard to argue that pricing plays a huge role in a customer’s purchasing decision. Even more, it influences their decision to sign up for a free trial: if the price is way out of their budget, this may play against even just trying it out.

If the pricing is within their affordable range, then what they’re looking for, at a high level, can be boiled down to clarity about:

The NOW: Is it clear what they are going to pay for and why?

The FUTURE: How will product value and price scale with their growth and engagement?

To help potential customers make their purchasing decision easier, your pricing model needs to consider 3 crucial input factors:

ICP knowledge. You have to know your customer’s characteristics, needs, use cases, problems, and company dynamics inside and out. This is where focusing on your Ideal Customer Profile (ICP) really pays off: the better you know your customer, the more meaningful and aligned your pricing model will be with their needs. A "spray and pray" tactic won’t help here.

Value metric. This metric represents your idea of how the core value of your product scales with more customer engagement and usage. For example, the number of events can be a value metric for an analytics product, and the number of projects for collaboration software, or storage volume for cloud storage. Of course, this is just a proxy for the key value your product delivers. By looking at the pricing model and seeing the value metric (e.g., “# of…”), the customer can understand if your idea of value scaling aligns with theirs, and if it’s a good deal for their money.

Willingness to Pay (WTP) is the prospect’s subjective feeling about your product’s worth. This may change during evaluation. For instance, they might initially think it’s too high, but after reviewing competitors, realize this price range is the norm for the category. Or their subjective feeling might change after an actual trial (in both directions). The most known method for researching market WTP and defining your pricing point is the Van Westendorp’s Price Sensitivity Survey.

In self-serve purchasing scenarios, it’s also crucial to understand your customer’s permission to pay — how much can they pay on their own? What’s the budget threshold that doesn’t require the company’s procurement process?

JTBD #2: Engage

The design of your pricing tiers should support customers in adopting and using your product. Engagement is the premise of customer retention and expansion, so everything — even your pricing system — should work to foster and strengthen it.

I’m sure we’ve all encountered products that put "spokes in the wheels" with usage limitations and paywalls. These felt unfair because they blocked us from getting the core value we hoped for.

While as an industry we’re shifting towards usage-based pricing, making this system truly work for the customer is hard. It might seem fairer as a concept, but aligning it with real customer value isn't always easy, because the value metric is just a proxy for actual product value (and in B2B products, it’s almost never straightforward).

Personal story: I spent mucho dinero trying to make a mini-app for myself with Replit. As a non-developer, debugging constant problems was a challenge, especially when Replit congratulated me that my app worked when it didn’t (but the credits were used…). Even if the problem was me, I still didn’t perceive this approach as entirely fair.

But isn’t there a risk of giving away too much for the price?

Here’s the thing: if your customers don’t use everything included in their plan (features and usage quotas), they’ll start questioning if it’s reasonable to pay that money for something they don’t use. If there’s a downgrade option, they’ll probably take it. If not, they might start looking for a cheaper solution, or for alternatives that, while perhaps less smooth or effective, are "good enough" for their money.

So your pricing model should be well-aligned with and supportive of:

Use cases, needs, and engagement trends of your ICP: Does the value included in their chosen plan align well with their needs? Does it provide the value they’re paying for? Are we giving too little, unnecessarily prompting them to upgrade just to unlock the value they were looking for, but coming with a shower of unnecessary features? Or, conversely, do they not use much of the stuff in their plan, which makes them potentially look for a solution with a more reasonable price?

Almost the same goes for your value metric (if you have one). The difference is that value metric quotas measure the volume of usage and engagement, while specific features in the plan cater to specific customer needs, pains, and goals.

JTBD #3: Retain / Renew

The third job-to-be-done is ensuring the pricing model actively supports customer renewals: after a billing cycle, are they satisfied with the value derived for the money?

This is all about subjective perception, of course. The equation looks like this:

Price < (Perceived value - Friction).

To promote renewals, you need to understand how your ICP perceives value, uses your product, how hard it is for them to overcome or put up with friction, and what stands in their way of renewing their payment (if anything). Especially look at the gap between engagement and renewals: if the plan and usage quotas are well-designed for their needs and context, is there anything else holding them back?

There are other, more technical contributing factors to this that I’ll discuss in the Churn 101 series.

JTBD #4: Upsell

When it comes to customer expansion, your pricing system should actively promote it. Sound product engagement is the foundation of your customer’s growth within your product. But if your pricing doesn’t make sense for their scaling, it can be a serious roadblock to an upsell decision, at minimum. At worst, it can cause churn.

This is where your customer knowledge is truly stress-tested:

Do you understand how customer needs, problems, and organizational dynamics scale with size (e.g., a growing team or even several departments) and more complex use cases?

Do you understand what the economic buyer cares about? And what concerns their purchasing committee might have (legal, compliance, security, integrations, billing, etc.)?

Especially in high-growth scenarios, do you see how your value metric supports or, conversely, potentially hinders their growth?

Lastly, how does an upgrade fit into their allocated budget? How is the decision made? Does each new feature correlate with what they perceive as viable for a price bump?

JTBD #5: Protect

Finally, you need to factor in cost scalability for your organization. Supporting high usage isn't always free (actually, it's never free). You need to understand your unit economics to design pricing scaling scenarios that don't violate them.

Of course, this is where AI costs come into play, as this is already our reality. If you have such a product, you need to understand where the computational differences lie. What user actions can sharply increase your costs?

This will depend on the type of solution you're offering, more specifically: what kind of tasks AI performs (is there a lot of variance in computational costs for each task type?), and what’s the average number of tasks performed by a user segment (this matters for certain task types or multi-purpose products).

I’m planning an article on understanding the pricing structure for AI features/products, so stay tuned! 😃

Pricing IS Product Value

The main thing I’m trying to convey here is that most people I talk to think of the pricing model as just a business asset. While true, I urge you to think about this in a dual mode: it’s also a form of value your product offers to your customers. Almost like a feature. And to make it work, it has to align with your customers’ idea of value.

These foundational pieces:

ICP knowledge

Value metric as a representation of your product's value consumption

Willingness-to-pay and permission-to-pay

Unit economics as a business and customer concept (after all, customers ultimately cover the cost-to-serve; poor unit economics can lead to unsustainably high prices, directly impacting the customer’s ability to get meaningful value)

represent the principles behind your model and pricing system design.

They are the direct inputs that determine your pricing model's ability to successfully execute its 5 Jobs-to-be-Done. Without a deep, continuous understanding of these elements, your pricing model risks failing to convert the right customers, adequately engage them with relevant value, foster lasting retention, facilitate expansion, or protect your business's long-term viability.

Pricing is as much your product’s value as your features are, and these four pillars ensure it's built on a meaningful, fair, and sustainable foundation for your customers and your business. And if it is so — that, in turn, will accelerate your business.

Pricing Evolution

Another crucial idea is that your pricing system evolves with your own growth.

It may look something like this:

Early stage: Here you may not even have a formal pricing model. Your main goal is to acquire customers to gather necessary data and feedback (your top priority) to pave your way toward PMF. Your pricing is flexible and typically very low because your priority isn't money per se right now.

Pre-PMF: Now things start to come together. You understand your customers and their usage much better, you have some traction, and your product works. Now you need to find a product-model fit. You design your first "real" pricing system and raise prices (often 50%+).

Post-PMF growth: This is where pricing becomes your growth lever. You experiment with tiers, value metrics, the model itself, and continuously revise your pricing points.

Maturing: You expand your pricing experiments beyond just the model: pricing localization, product bundling and unbundling, discount systems, price flattening, etc.

Along this journey, your ICP also evolves: who they are, their needs and use cases, willingness-to-pay, and usage patterns.

They evolve almost in unison with your pricing and serve as stepping stones for each other. This dynamic interplay underscores why your understanding of the foundational pillars — ICP, value metric, WTP, and unit economics — must continuously deepen and adapt alongside your product and market.

Your pricing model's evolution is inherently a reflection of your evolving insights into these core elements, ensuring it remains aligned and effective at every stage of growth.

Bonus: Ownership

Because pricing is seen only as a business asset, it’s often "owned" by the C-level suite, with the CFO implicitly appointed as head. Most times, this means pricing is a "no-go" territory. I’ve rarely seen pricing experiments, and even when they happened, it was a point of anxiety and control from the CEO.

But when a team is responsible for revenue targets (product & growth teams increasingly own parts of product revenue), how are they supposed to work with this lever if they’re not allowed to touch it?

So products evolve, customers evolve, but pricing either doesn’t, or does so in a non-experimental way — just rolling out a new pricing plan out of the blue with a big announcement. No wonder it results in problems.

Again, this mindset centers around the thought that pricing only impacts revenue. But it also influences operations and efficiency, and of course, customer experience and behavior. It’s only fair that working on pricing should be a cross-functional effort.

But even if you have a cross-functional Monetization team, they’re rarely allowed to go beyond incremental improvements like pricing page design, added payment methods, in-product monetization awareness, etc.

They rarely can just drive structural changes, like pricing points, plan design, value metric, local pricing, etc. This makes sense as these change the structure of company’s revenue and require robust exploration, alignment, and sanity checks. And leaders must be involved here.

I’m a big fan of Programs, and in this case, I advocate for a Monetization Program that oversees pricing evolution. Here, a tight-knit group of cross-functional leaders makes decisions and owns the pricing evolution.

This is becoming even more important now, as AI pricing must change to account for new usage patterns and unit economics.

Good luck!