How to PLG for B2B SaaS Startups: Product-Led Growth "0-1" No-BS Guide

A practical roadmap for B2B startups to build their first Product-Led Growth motion without perfect data, huge teams, or endless resources. Focus on what matters in the Build phase.

So you’re thinking about building a Product-Led Growth motion in your SaaS startup, but not sure how and where to start?

I get it. Most PLG advice out there talks primarily about optimization and innovation — the later stages of PLG maturity, and is targeted towards more mature companies with established teams, clean data, significan resources.

Very little is dedicated to the Build phase, where most startups actually live.

Here’s the truth: you don’t need lots of money or resources to start. What you need is clarity on what matters now, and understanding the right time to do each thing. The rest is execution.

This practical, no-BS guide will help you understand:

What exactly we’re talking about when we talk Product-Led Growth

Whether your product and company are ready for PLG

What to focus on in the very beginning (and what to ignore)

How to kick off PLG in your organization the right way

This guide focuses exclusively on the Build stage and is tailored for startups with constrained resources and limited clarity.

I’ve been working in and with startups for almost two decades. This guide cuts through the noise and gives you a practical roadmap for getting your PLG motion off the ground without requiring perfect data, huge teams, or endless experimentation cycles.

Table of contents:

🚀 Let’s get started!

1. Product-Led Growth in B2B

Before we dive in, let’s make sure we’re aligned on some PLG essentials.

Our human reality is inherently semantic, and words matter — they create our worldview. So let’s spend a few minutes here to come to a shared understanding and save ourselves time down the line.

What we think about when we think about growth?

For most people, it’s what they’re lacking at the moment. It’s a fluid concept with no hard rules.

But…

In the early days startups’ main objective is to get more customers, right? It’s natural they’re obsessed with acquisition. It becomes a problem when founders carry on this acquisition-first mindset into further lifecycle stages of their startup — this can break a business, for real.

And even though 80%+ of people equate growth to new customer acquisition (no data, just personal experience), this is just one type, or lever, of growth.

What happens to these new customers is an even bigger question:

Do you lose them or do you keep them?

Do you just keep them or do you grow them?

Do you keep and grow them at all costs or profitably?

All this doesn’t happen by itself. It’s actual work. Deliberate growth work. And there’s more than one way to do this work.

There are different approaches and operating models of how companies can drive consistent full-funnel growth — growth motions. There are three distinct growth motions for a B2B business: Sales-led, Marketing-led, and Product-led growth.

Each has its own strengths and limitations. A strong B2B growth strategy is not an either/or game — it smartly layers these motions to maximize results and secure all flanks.

B2B vs. B2C growth

Growth approaches for business and consumer software differ because they have different focal points:

B2C products focus on user acquisition and free-to-paid conversion. Consumers are budget-conscious, so success means increasing user volume.

B2B products focus on strong product engagement that drives long-term usage and upsells. Business customers aren’t as budget-constrained, allowing to sell more value to existing customers: additional products and features, larger usage volumes, more seats.

Why this matters: Product-Led Growth is often equated with traditional B2C growth. While PLG has its roots in consumer apps, these different focal points mean PLG in B2B is far more a product engagement strategy than an acquisition strategy.

The dual nature of Product-Led Growth

Unlike Sales-Led Growth (driven by relationships and negotiations) or Marketing-Led Growth (driven by campaigns and demand gen), Product-Led Growth makes the product itself the main vehicle for distribution and sales. Users can discover, adopt, purchase, and continuously engage with the product without human intervention.

This is what makes PLG unique: it’s both a Go-to-Market (GTM) strategy and a Product strategy.

As a GTM strategy, PLG defines how you bring the product to market: who you sell to, how you position it, which channels you use, and how you acquire customers. It’s front-loaded, focusing on launch, market entry, and scaling into new segments.

As a Product strategy, PLG is a repeatable model for how your product and product org drive ongoing growth after you’ve landed customers. The emphasis shifts to scaling usage, monetization, and expansion. It can’t live outside the Product territory and must be tightly aligned with it.

Read more on Product Growth here:

As such, Product-Led Growth has a dual nature:

It’s the market entry strategy geared toward lower market segments

It’s an engine that sustains and compounds growth through increased engagement and built-in expansion pathways

Or, as I call it, a full-funnel growth strategy :)

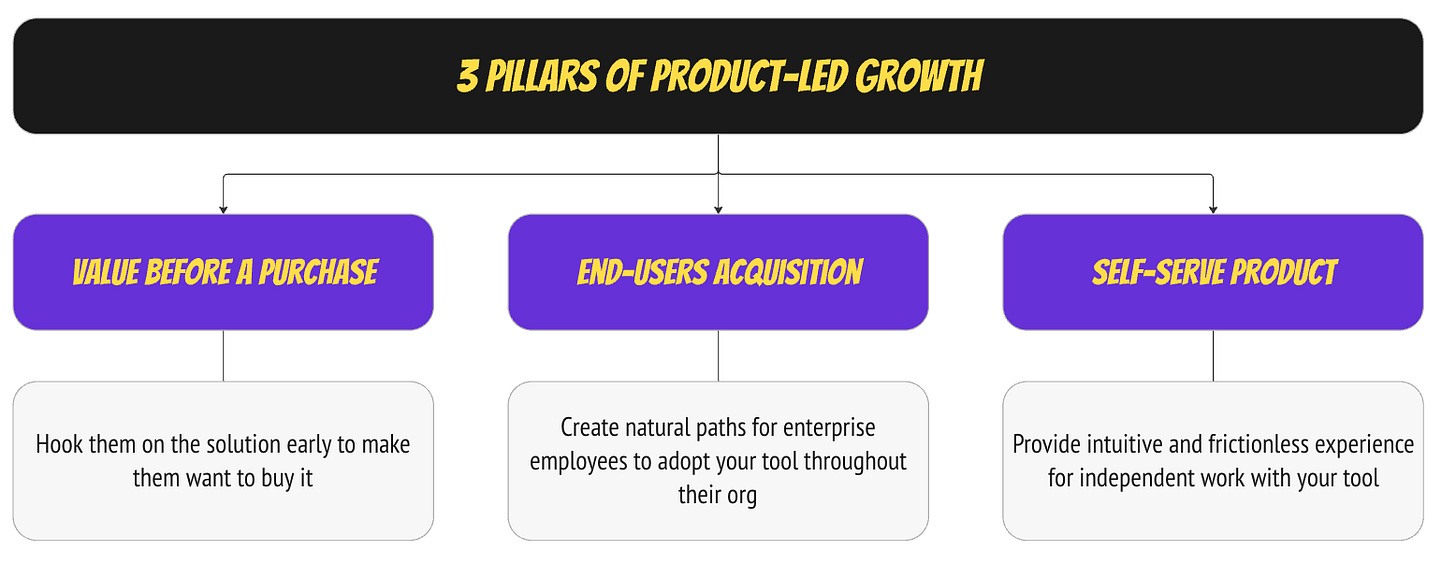

Three pillars of Product-Led Growth

This motion relies on three foundational pillars.

1) Showing product value before a purchase

The idea is to facilitate a purchasing decision by proving that the product can deliver on its promise. Sharing this value for free allows potential customers to make an informed selection and increase their intent to use (and buy!) by experiencing the benefits firsthand.

The tradeoff? You’re giving away product value for free without any guarantee of conversion, which especially problematic for products with high cost-to-serve, like AI products.

2) Capturing individual users, not enterprise buyers

The main idea is to win over end-users who adopt the product themselves, then bring it into their team, and eventually across departments until it lands an enterprise deal.

This is an ideal scenario. In reality though, this means casting a wide net: acquiring not just employees of various enterprises who promote adoption within their organization, but also prosumers with individual use cases, and SMB employees with small teams.

This means that only a fraction of new accounts will translate into enterprise deals, and even for them, it may take months before meaningful revenue materializes.

3) Self-serve product exprience

The product itself guides the user through the entire customer journey, without any humans in the loop. If done right, PLG becomes your most cost-effective growth engine.

But building frictionless user flows (from signup to payment) and the infrastructure behind them takes months or years before you can scale.

All in all, PLG is not cheap growth — it’s a long-term operating model that front-loads effort and investment, but compounds over time once it’s in place.

Advantages & Disadvantages of PLG

Let’s quickly summarize the benefits and contributions of Product-Led Growth to your business growth:

Customer advantages:

Improved customer experience

Faster and smoother time-to-value

Higher satisfaction and advocacy

Product development advantages:

More focused product development

Accelerated feedback loops and expanded data pool

Data-driven and faster decision-making

Better alignment across departments as the product serves as the unifying focus

Competitive advantages:

Higher chances of customer consideration for procurement

Market defensibility (competitors won’t eat away your market share in a different segment)

Natural market expansion

Business advantages:

Acquisition efficiency and lower CAC via product-led channels

Higher conversion rates from engaged, higher-intent users

Shorter sales cycles

Higher CLTV and retention

Natural growth paths within the product

Higher ARR/FTE

The main disadvantages:

Significant investments into building and optimizing performance to the maximum

Longer timeframes for materializing true B2B revenue from upper market segments

Making peace with the fact that many accounts will be free or low-ticket value

Product-Led Growth motion vs. product-led tactics

Product-Led Growth as a motion enables the product itself to acquire, engage, retain, and monetize users—moving them from signup through adoption, habit formation, payment, and expansion.

Product-led tactics are separate techniques that improve product adoption and engagement within a sales-led motion. They help, but aren’t accountable for growth.

For example, a sales-led product can have a trial and product-led onboarding, but all purchasing (initial conversion and upsells) goes through Sales. Yep, this happens. These tactics improve the product experience and user engagement, but they don’t replace the sales motion.

Some products can’t support a full Product-Led Growth motion due to their product context and value structure (more on this in Section 2). They can’t do PLG in its entirety, but they can still employ product-led tactics to improve the product and provide a better end-user experience.

Besides, I’m convinced that pretty much every PLG effort starts with tactics. Tactics help teams get started, prove PLG viability and potential, get leadership buy-in for further investment, test hypotheses, and gain necessary learnings.

And this is what this guide will be about.

For more on the PLG spectrum and motion vs. tactics, check out:

2. Are you ready for Product-Led Growth?

For B2B startups, I recommend to always start with Sales, then layer on a Product-led motion.

But when exactly? With Product-Led Growth, there is, in fact, such a thing as “too early.” Building a new growth motion isn’t free, and we don’t want to prematurely invest into too much ambiguity.

I suggest checking your readiness on three levels:

Is your product eligible for PLG?

Are you at the right stage to start building PLG? Is your startup ready?

Is your organization ready for a new growth strategy?

2.1. Is your product eligible for Product-Led Growth?

While employing some product-led tactics is absolutely for everyone, building a full-scale Product-Led Growth motion isn’t: there are products that by their nature won’t be able to realize PLG’s full potential.

Let’s bust another myth here: lots of people think that enterprise-focused products are ineligible for PLG. But the market segment focus isn’t the right criterion here: if this logic were correct, then every B2B SaaS would be ruled out, as all of them eventually want to go for enterprises (after all, this is where the real B2B money lives), and we wouldn’t hear about such PLG-Behemoths like Miro, Figma, etc.

What truly matters is the nature of your product value, and there are really just two hard rules your product needs to fulfill to “qualify” for Product-Led Growth:

Rule #1: Bottom-up adoption should be possible in your market

If people in your market can’t adopt tools on their own, PLG will break before it even starts.

There are markets (e.g. highly regulated environments) where employees must stick to strict rules for security and safety, and have a formal chain of command. They are not empowered to find and test software independently and mandate its adoption within their team — this lives with a central authority.

Even then all may not be lost: you can target middle managers who have the authority and budget to test tools and mandate its usage in their unit (e.g. regional office) without the need to escalate to higher management — a “middle-out” adoption motion. It’s not always possible, but it may be.

Rule #2: Your product must deliver clear value to individuals and small teams

This is a structural limitation. Remember that PLG captures individual users, gets them to adopt the product in their immediate team, and then potentially promote product adoption in other teams and departments.

Some products, however, can’t show their value to individual users or small teams. For example, enterprise access and identity management systems that aren’t designed to manage individual accounts (you could, but is it worth the price?) These only make sense when managing hundreds or thousands of employees across dozens of applications.

This is why people say PLG isn’t for products serving enterprises. But let’s be semantically correct: if some enterprise software isn’t made for Product-Led Growth, it doesn’t mean Product-Led Growth isn’t for enterprises.

If one of these two fails, PLG is not your motion.

But even if they both hold, it may not be the right time yet for your product to go PLG. There are also “soft” rules in the sense that it is in your control to make conditions fruitful. But until they are, your PLG investment will likely be wasted.

Rule #3: Your product should have a collaborative use case

Without a collaborative use case, your individual signups won’t grow into team accounts, and you won’t be able to sell into bigger organizations over time.

If you’re a prosumer SaaS that wants to move upmarket, you need to deliberately manufacture, promote, and scale collaboration in your product.

I started using Notion as soon as they launched, and back then they didn’t have team collaboration capabilities: they were purely a tool for individual notes and documents. Notion developed projects and documentation collaboration over the years, and now they’re one of the most successful productivity B2B tools!

Rule #4: Your product should solve a recurring problem

If your product solves a one-off or rarely occurring need, it’ll be difficult or impossible to promote natural usage habits and integrate your tool into the customer’s value chain.

Daily or weekly usage frequency is ideal, as it drives stronger engagement, retention, and customer growth. Otherwise, you’ll need strong human relationships to stay top-of-mind for their next problem-solving cycle.

While your main use case can occur annually, you can develop additional use cases with higher frequency. Say, your SaaS for annual employee performance reviews may be supplemented with more frequent use cases, e.g.:

Employee development planning and tracking (weekly or monthly)

1:1 meetings tracker and documentation (weekly or bi-weekly)

These use cases can attract middle managers into your Product-led motion. Although by that time, you may not be a startup anymore. 🙂

Rule #5: You should have clear market positioning and messaging

Simply put, if you’re trying to create a new market category, it’s too early for PLG: the problem-solution space should be well-known to the market and end-users to start looking for a new tool themselves.

Rule #6: Your product shouldn’t require your assistance to set it up

Many B2B products are complex and need some setup to start generating value. Sometimes, the initial user isn’t the right one to do the setup and will need assistance from someone, like an engineer, which makes the self-serve setup even a bit more complex.

Lots of early-stage startups haven’t yet figured out an effective and clear self-serve setup process and assist their customers with that. That’s ok, you’ll get there with time.

But if you’re not planning to ever allow your customers to set up the product by themselves, then a fully-fledged PLG motion isn’t for you.

Understanding these constraints early helps you make realistic decisions about your growth strategy and avoid investments into something that is not even meant to work.

2.2. Is your startup ready? Signs of Product-Market Fit

Everyone says “Don’t do PLG before you have PMF.” Product-Led Growth scales the distribution of your product, and it needs to work first.

Truth. But when is PMF?

There isn’t one universal definition of Product-Market Fit, so we have to rely on its signals:

Sustained usage: a signal you’ve built a valuable solution for your defined market.

Traction: a signal that you’ve found the right way and words to capture your target audience’s interest, relate to their problems, and convince them of your solution.

Sustained usage

Simply put, you see that users consistently return to your product to derive its value.

Look at your user retention curve: in the beginning there’s an inevitable drop-off, but you want to see that this curve flattens out (don’t have to be perfectly flat). If it does, that’s an indication your product is valuable for someone. If you have different personas within your target audience, make sure to track them separately.

Min. 20% of your new usersbase should maintain activity (perform the “core action of value”) for 6+ weeks.

40-60% indicates a sound Customer-Problem-Solution fit.

Your engagement metrics (e.g. WAUs) should also be trending up.

Traction

More customers should be joining each month than the previous one. We’re not looking for crazy growth, just consistent. In general, acquisition should just be getting easier.

This says you’ve more or less figured out your targeting, positioning, messaging, and a suitable channel.

Ideally, a portion of your new customers should come through organic channels — this is truly a signal of the value to the market.

Your avg sales cycle duration and sales conversions should improve: ~10% CR without warm intros is a great sign.

Other signs

It’s also great to witness:

Some renewals are happening.

You increase your prices and it actually works: a very strong indicator.

Your NPS is going up, you start seeing more 9s and 10s

Some people say that $1M ARR signifies Product-Market Fit. While it may be true, it’s not a definitive benchmark and should be supplemented with the signals above. Besides, so much depends on the market, competition, your solution, pricing, etc. Remember that correlation is not causation.

Crucially, for ARR to signify PMF, it should be coming from the same customer segment. If it’s split across multiple customer segments and use cases, that cannot be seen as a PMF signal.

Having evaluated hundreds of companies for signs of product-market fit, I can assure you that there’s no specific revenue benchmark that definitively signifies product-market fit.

— OpenView

2.3. Is your company ready for a new growth strategy?

If your product is ready for PLG, it doesn’t mean your company is. It’s nothing short of an organizational mindset shift, and you have to have just a few things in place to ensure it’s not going to be a total mess.

I’ve been working in and with startups for almost 20 years now, so I get the constraints (hence this guide). A lot of PLG advice assumes you have the resources and infrastructure of a scaling company. You probably don’t. So let’s focus on what actually matters at the start.

NB: I’m deeply convinced that clarity is the main resource you truly need: it’s far better to start with clarity and little data than with abundance of data and little clarity. Sorry to all “bias for action” folks — I’m in the camp of “let’s figure out what we’re doing first, then do it.”

To ensure your PLG start will be effective (not fast and smooth), this is what you need:

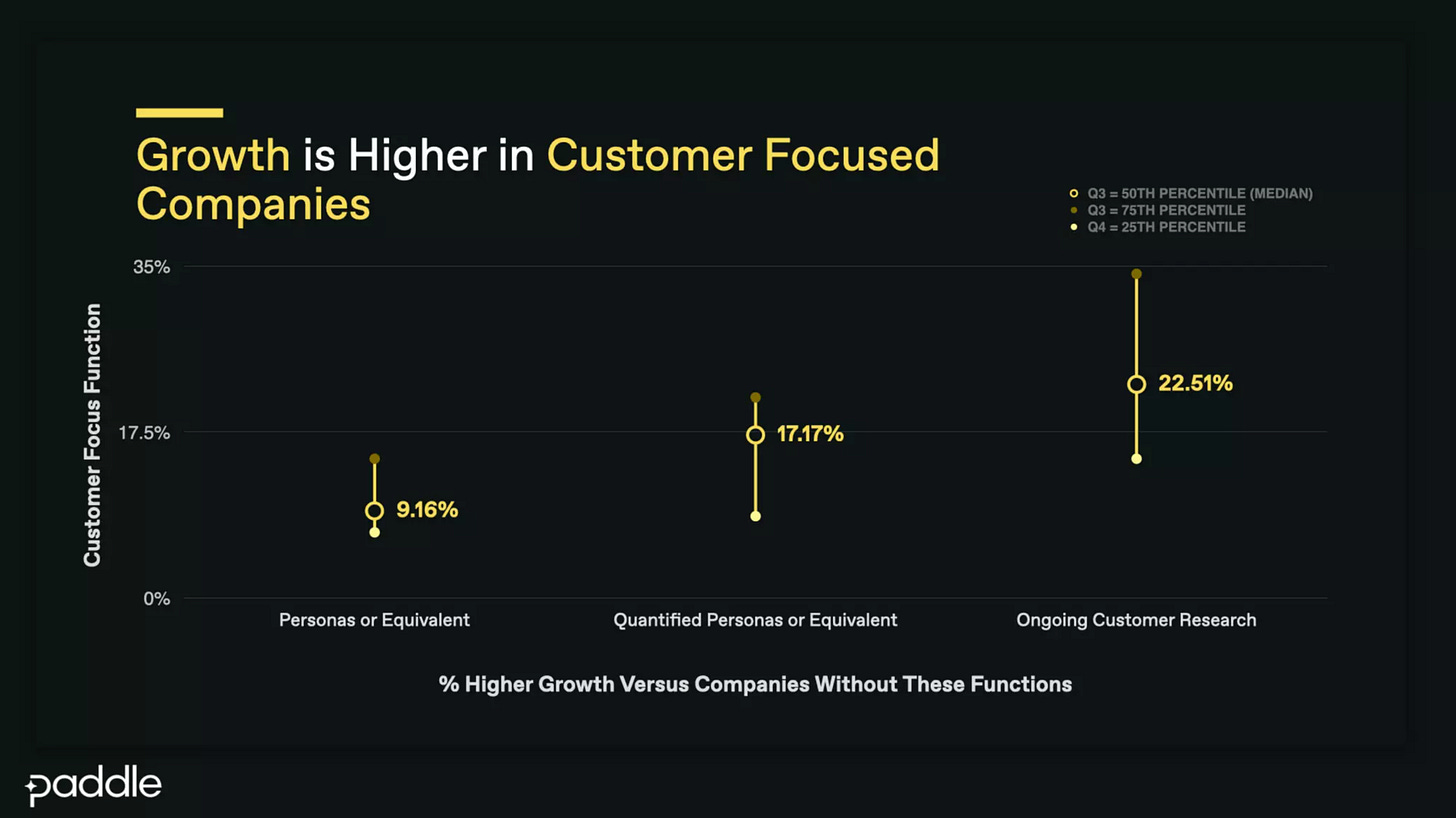

2.3.1. Customer Intelligence

This is always important, but even more so for PLG: selling via Sales can be pretty forgiving in this regard (you can adapt, adjust and improvise). But product-led distribution is unforgiving: you can’t just create a random self-serve product — it should mirror the user’s reality as close as possible.

Too many companies think they know their customers, while in reality they... kinda don’t 🤷♀️

Where to start? With your ICP!

The ICP (Ideal Customer Profile) topic is complex. It’s counterintuitive. Think about it: to get your business going, you need to sell it only to one segment of the market. This goes against all intuition we have about this world.

Everyone tells you to focus on ONE Ideal Customer Profile. The word “ideal” literally means one, the best. But too many founders don’t listen until their business starts failing (The “Everything for Everyone” Startup Death Trap). Only then are they able to understand the true meaning of selling to an ICP.

Let’s not be them. Trust the experts: sticking to your ICP can make or break your growth.

Simply put, your ICP is the type of a customer that would have the most success with your product. Or, as I put it, who “stays, pays, and prays for your product”.

ICP is defined through data: acquisition and conversions, engagement and retention, satisfaction, and expansion. In the very beginning you won’t have enough of it to give you a definitive answer. But when you have signals of PMF, you should already have good directional signals of who your ICP is.

With PLG, we should go a step further and define your Ideal Individual User Profile: typically a persona within your ICP who’s most likely to discover, adopt, and engage with your product. For this you should have a deep enough understanding into your user personas, not only market intelligence and buyer profiles.

2.3.2. Data

Product-Led Growth and data are like two sides of the coin. But in the beginning you don’t need loads of data or advanced data skills and setup, so don’t be intimidated by this. What you actually need is:

a) Clean data

Before you start, make sure to:

check your main metrics definitions and events, and ensure there’s just one event per metric (because every department loves to have their own!)

establish a clear event naming conventions for everyone in the company to stick to.

unmess your existing reports and dashboards (or you’ll get drowned in them).

b) Access to data

If you have self-serve analytics, great! But if you don’t, it’s not the end of the world. Use spreadsheets, SQL, AI, pair with an analyst — it doesn’t matter.

What matters is that you can answer your questions swiftly, without going through the hoops of creating Jira tickets for the data team who will never have time for you (if you know, you know).

c) Clarity on what is success & impact

You have to understand the structure of your business and revenue to be successful at growing them.

In the beginning, you won’t need a lot of targets (more on them later). Nonetheless, I urge you to get your entire leadership team to create a “Driver Tree” for your business success to understand and outline your entire system of levers you can pull to increase revenue (or other form of impact). This is an invaluable artifact for the entire company that will help you stay aligned and clear in the future, so do it early.

By the way, if your product team doesn’t yet operate in an outcome-driven way and their goal is to deliver features instead of customer and business impact — this is your sign to start learning and doing modern product management.

This is enough for now. In the future you’ll get more advanced and will start to correlate end-user data with account-level patterns, and connect product data with marketing and sales. But for now don’t get carried away by this.

LOW-DATA B2B ENVIRONMENT

Everyone knows that Growth relies on experiments. But B2B products have far fewer customers and users than B2C, especially startups. So how do you experiment in this reality?

First, you don’t need to A/B test everything. There are other validation techniques that give you enough insights without a need for loads of traffic.

You’ll have more traffic on the homepage, pricing page, and signup flow, so A/B test there. But even then you may not hit 95% significance. Lower it to 80% or 70%. Early on, you don’t need precision — you need direction. Precision matters at scale where every percentage equals thousands of dollars.

Second, less quant data means more qual data. And the less customers you have, the more you can stay close to them, talk to them, observe them, in order to raise your confidence (the goal of experimentation).

When traffic is low and every signup is precious, put rigor in your hypotheses: understand well what you want to learn, how you’ll define success, and who your audience it. The more precise and homogenous your segment, the lower sample size you’ll need.

2.3.3. Alignment

Misalignment, lack of buy-in, and wrong expectations are the most common source of growth problems. Let’s go through the main pitfalls that will get in the way of your success.

a) No leadershup support and buy-in

Your CEO and immediate manager must be bought into PLG and act as your “sponsors.” Without their support, everything you do will be an uphill battle. Worse, they may diminish the significance of your wins (it’s human nature to resist what we don’t like) and/or penalize you for “rogue” actions.

Sometimes they’ll be natural supporters. Other times you’ll have to build the case: outline the experiment, agree on success criteria, and address their (likely valid) concerns. It’s all about communication and leadership.

It’s okay if other company leaders don’t support you yet. Your goal is to prove PLG viability with real results and earn their trust.

b) Wrong expectations

When people hear about Product-Led Growth, they often think about explosive overnight viral growth. That’s rarely a reality.

PLG is long, deliberate work. Most progress is slow, incremental, and unremarkable. Big wins are compounded small wins over time. If your execs expect fireworks and you deliver campfires, you’ve already lost.

The other common trap: expecting immediate wins. Growth is based on a scientific method, and early days are all about learning, not impressive results. It’s understandable that founders want to see tangible ROI even before they greenlight a new growth team. But if that team faces pressure for immediate results, they’ll drown. They need runway to learn and gain velocity.

с) Misunderstanding Product-Led Growth implications

I’ve learned that PLG is perceived very differently by different people. If your CEO thinks about PLG as cheap virality, and you think about strong engagement that translates into retention and expansion, it’s best you uncover this early.

And... Product-Led Growth should be treated seriously.

Execs need to understand that it’s a company-wide growth strategy, not a PM team toy, not an initiative on a product roadmap, and certainly not a couple of tickets on a platform team’s backlog. Every functional department will have to contribute to make it work. And it deserves not only its own strategy, but its own team that has different skillset, priorities and goals, and MO than core teams.

d) Product <> Sales Friction

Fact: Sales are often nervous about PLG. They’ll say “Product should focus on customers and leave revenue to Sales!” or “Why even bother with these low-ticket customers?”

This tension is understandable. Sales used to control customers and deals. With PLG, they think they’re losing that control. That can feel threatening: they all have quotas to hit, and commissions to earn.

Position PLG properly: it captures customers outside the sales target segment—those with simpler use cases, earlier in their problem-solving cycle. Product nurtures them into high-intent, potentially high-ACV PQLs that Sales can then close. It’s not a threat, it’s a pipeline builder.

The real friction? PQLs take months or years to develop. Sales may see this as missed opportunity, but remind them: they wouldn’t have captured these users anyway. Sales doesn’t work with individual users, and buyers rarely just stumble upon tools.

The reality is: clarity beats perfection every time. Get clear on these three areas, and you’ll have a foundation strong enough to start building your PLG motion.

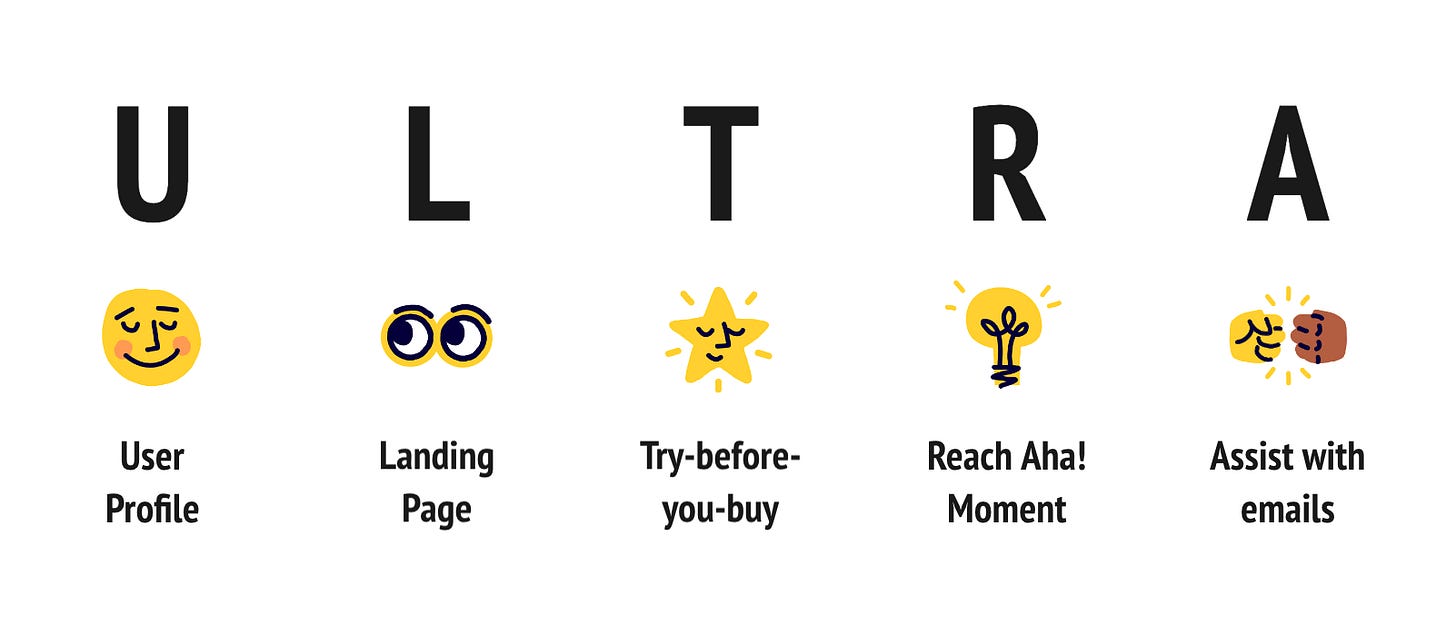

3. ULTRA Framework: 0-1 PLG Roadmap

You’re clear on what Product-Led Growth means for B2B, and whether your product and company are ready to start building this new motion.

Now what?

PLG experts (including yours truly) will tell you that it’s a complex system, and growth strategy and execution requires expertise and experience. Legit.

But this is what I have come to understand through my conversations and work with startup founders: their initial problem is universal. So is the solution that I’m offering in this guide.

What do all startups care about the most? Increasing the pool of paying customers. This capital will fund all future work (not only in money, but also in data and learnings). If they do not have the right mechanisms to convert customers, there’s no sense in TOFU growth, elaborate engagement strategies, or monetization optimization.

It’s an ideal place to start with Product-Led Growth: generally a low-risk and lower-investment area with plenty of optimization opportunities, and a fruitful learning environment. Conversion rates also make a perfect North Star Metric (not too complex, but significant enough to build trust and prove viability).

If you already have some of the steps in place, skip them. The task is to tailor this framework to your context. But make sure you have all 5 parts in place.

Step 1: User Profile

If you have established your ICP (at least a sound qualitative hypothesis), you can derive the profile of your Ideal User.

Who is the person within your ICP (role, function, seniority, etc) who is most likely to be:

Motivated enough to discover and try your product?

Able to use and adopt it without external help?

Have the permission to invite teammates to work on projects together?

Potentially, pay for it too (not the enterprise tier, of course)?

Start with a qualitative hypotheses informed by your existing insights and intuition, and validate or refine with quantitative data.

Look at the first users in your successful accounts, their characteristics and behavior trends, and what role they take in further account adoption and engagement. Do they advocate your solution or serve as champions in the buying process? Do they invite other users and share their work with them? Do they leave good testimonials and give proactive feedback?

It may be challenging as B2B tools can be horizontal and serve multiple roles and use cases. In this case, you need to prioritize one user profile — a strategic tradeoff that will help you strengthen your offer, focus on value delivery and onboarding, and decrease churn.

If your product serves SMBs: The first user can also be the buyer.

If your product requires technical setup: The first account user may not necessarily be the first value recipient. For example, an engineer setting up product analytics prepares the ground for others to use it. Remember this when you look at your data to avoid confusion or frustration. Your customer knowledge should pay dividends here.

Work with them like you normally would with a product persona. Understand their desired outcome, main problems and gaps in current solutions, and how your product can benefit them. Understand their individual use case as well as how they work with their team, and their collaboration dynamics: Who do they work with more closely? What is the nature of this collaboration? What are the tasks, outputs and outcomes? Which users have which roles: who creates content, who consumes it, who shares?

This is ground work that is a foundation for every net step (not just 0-1 phase, but subsequent optimization and innovation phases), so make sure you do it diligently.

At the same time, don’t let yourself get stuck in analysis paralysis. It’s a constant iterative process where you have to be robust about updating and documenting your knowledge that will inform your next iteration.

Put your rigor into discipline rather than reaching 100% certainty (you won’t).

Step 2: Landing Page with a tailored offering

This is a simple but crucial step that a lot of teams skip or get wrong.

If you’re a sales-led B2B startup, your homepage is oriented towards buyers and focuses on capturing leads. Because many B2B SaaS products are complex, so is their homepage: it covers a variety of use cases, industries, and segments.

As a result, this page very often has fuzzy messaging and product offering: it will be hard for your target user to understand that this product is for them, why, and how it helps them do their job well. Remember, their problems are of smaller scope (individual or team-level) and are more concrete, oriented at immediate benefits and outcomes, not company-level ROI.

So what a lot of teams do is they start redesigning their homepage🙄

This is a massive initiative that involves multiple stakeholders and takes a lot of time and approvals. It doesn’t only make it hard to launch, but iterate on it, too. Every version will have to go through the same hoops.

Besides, such a big change guarantees initial decline of performance. But no one has relieved yout homepage of responsibility to work with leads and buyers just it. It’s not what anyone wants or needs right now.

Other teams understand that and just slap the “"Try for Free” button in the navigation. The rest stays the same. Needless to say, their trial signups aren’t doing well.

I recommend starting with a separate targeted landing page to attract your ideal users and convince them to try it in a language and design that resonates with them, and use this page for your paid, content, and social campaigns.

You’ll have full ownership of this page and can iterate on it to your heart’s desire, and it will be far easier to track the results. It’s super easy to build today, so there’s no excuse.

After confirming your hypotheses and ultimately proving PLG viability for your product, you can adjust your homepage to accommodate the new product-led motion.

Step 3: Try-before-you-buy model

The core premise of Product-Led Growth is to let users try the product by themselves and see it in action before they commit to a purchase.

There are two most common “Try-Before-You-Buy” models: Freemium and Free Trial.

I always recommend starting with a Free Trial, because Freemium is really not easy to do right, and it’s a lot of product work. A trial, on the other hand, doesn’t require too much thought process, and it’s faster and easier.

Of course, simpler doesn’t mean better. Ultimately, you’ll have to choose a model that allows users to experience the product value in the best way, and can drive attention in your competitive space. It can be freemium or a special version of a trial (e.g. usage-based or credit-based trial). I just suggest you postpone this important work to later stages.

I also recommend using the standard 14 days duration, as 7 days is usually too short for business software to really feel it. Even 14 days may not be enough, and in the future you may build a freemium or a sandbox environment. For now, consider trial extensions for promising users.

Should you ask for credit card information during signup? I recommend not doing this, or you’ll significantly limit your new active userbase and deprive yourself of the necessary learnings (not every employee is permitted to make a purchase, and they won’t use their personal data for work software).

If your product has high cost-to-serve (e.g. you’re a fully AI product with obvious costs), then usage- or credit-based trials are for you. But if you only have some AI feature(s) in your product, provide a standard 14-day free trial for your main product and add credits for a limited trial of your AI feature.

POTENTIAL ADDITIONAL DEVELOPMENT

a) Self-serve signup

If you don’t have one yet, you necessarily have to create it.

b) User profiling survey

You must ask your new signups essential information about them and their company to identify and Ideal User and send them to a relevant experience flow. Also, this data is critical for your product analyses and reporting.

Don’t overdo it with questions and only ask truly relevant ones:

About them: their role, department, intent, use case.

About their company: company or team size, industry, and whatever else is relevant for your ICP.

c) Self-serve purchasing flow

In Product-Led Growth the product should be able to sell itself, so if you don’t yet have self-serve payments, it’s time. Integrate Stripe or an equivalent, use the most common payment options, don’t do anything customized just yet.

If for some reason you can’t do it right now (e.g., tech, operations, or even legal constraints), it’s okay. When the trial expires, direct the customer to book a meeting with a sales rep. Not everyone will do it, but it’s better than nothing.

🚨 If you do not have open pricing for self-serve product: I’m not covering this complex topic in this guide, and will be working on it in the near future (subscribe!) If you have questions about how to create your first pricing system, feel free to send me an email or connect on LinkedIn, and I’ll do my best to help you.

Step 4: Reach the Aha! Moment

For your user to make up their mind about purchasing your product, they need to understand what it gives them, how it helps them, what are they going to pay for?

This is tacit knowledge, not just information. They have to see it, touch it, feel it, to understand if it fulfills their needs or not. And your product has to guide them. Where exactly? To the moment when the user understands what consititutes the product value, the Aha! Moment. And do so fast (ideally in their first session), because people get distracted and forget.

This is not a guide on Activation and onboarding, so we will not spend time discussing the details. There’s also a high chance you know about it too well, as this knowledge is a commodity now. If not, here are a couple of foundational resources to get you started on the topic:

Here, instead, I want to share some important nuances of B2B product activation that are rarely spoken about and are one of the most common points of confusion.

1. Aha! Moment ≠ Setup completion

This is still a wildly common misconception, unfortunately. It typically concerns products with a complex setup — it may involve a few steps, and teams think that once it is complete, the user is activated. It is not so.

Consider an Analytics SaaS as an example: it requires installing their code into the customer’s website in order to collect data that will then be interpreted and visualized in the product dashboard. Having the code installed and confirmed is the Setup moment, but not the actual value. The customer doesn’t pay money for this product to just collect data, right? They pay to be able to see performance, analyze data, derive insights, share reports with others, and so on — this is the value they expect.

Setup is just a necessary prerequisite for your product to function and generate value for users, not value itself.

2. Complex Aha! Moment

Often it is really not easy to define this moment in your product.

The Analytics SaaS is a great example — when does the user truly understand the differentiated value of it? Is it when they create their first report? Or dashboard? Or receive a notification about some error or performance issue? It can be truly, truly hard to define the Aha! Moment.

In such cases I recommed to look for value proxies. This is how:

Understand what real-life outcomes (not actual metrics yet!) correlate with your users’ success. In our example it is likely to get an insight from data. But there is no action within the product that directly represents what’s going on in the user’s mind, right? Don’t panic.

List a few things you can measure that connect to this value definition as close as possible. Think like your customer, not an engineering team. At the same time, it’s important to let go of perfectionism, or you’ll get stuck in analysis paralysis.

In our example it can be creating a report, working with the report (e.g. applying fiulters), setting up daily alerts for a report, etc.Correlate each such action with overall engagement strength (e.g. frequency, longer sessions) and retention, and pick a winner.

It’s not perfect, but it is reality for some products. As they grow and improve and get more learnings, they will keep iterating on this. Just don’t start creating elaborate metrics that are hard to understand and maintain — it’s only going to confuse you.

IMO, it is better to remember you’re using a proxy than trying to retroactively fir the Aha! Moment metric to create a good reporting picture and forget what are the real customer outcomes and expectations.

3. Delayed Aha! Moment

In some products it is not possible to experience the Aha! Moment soon after a signup. For example in seasonal businesses. Or, say, when the Aha! Moment can only be experienced through collaboration, but to get there the first user needs to invite their team and wait for them to complete the required steps (I’ve seen this taking weeks).

This is truly inconvenient for teams working on activation. I’ve seen them redefine the Aha moment to fit users’ reality to the product. But they’re only tricking themselves. They may get “great activation rates,” but what’s the point if they don’t convert into retention and monetization? Reality is what it is.

There are three ways to deal with this:

Go for a usage-based trial or freemium to not abruptly end the trial before the user has a chance to get to the Aha! Moment. It may not be as easy as a time-based trial, but definitely makes more sense for your product.

Consider creating sandboxes and test projects that emulate value delivery on dummy data (and even dummy collaborators). But this requires development and isn’t the best option for an early stage.

Create an interactive in-app demo to guide the user through all the necessary steps consequently to help them “learn by doing” without the need to create any projects themselves. This should be a temporary solution until you find a better way, but it’s better than nothing.

4. User profiling ≠ Setup

Profiling survey helps you identify the type of a user and slignshot them to the relevant onboarding experience.

Setup moment is the milestone when the product is properly configured to provide the intended value to the user. It can be just one simple action or a process with multiple steps. It may even be absent at all, it happens — doesn’t mean you have to create one artificially. Stay close to reality.

5. Setup moment can be your biggest dropoff point

But more often, B2B SaaS have rather complex set processes that may even require support from other roles, making it a #1 reason for activation dropoffs.

If you’re a product with a high setup barrier, put your focus on this first milestone: provide lots of information (text and video guides, webinar recordings, even ticket examples for engineers), offer support of your technical team, and consider turning on a trial only after the setup is complete.

6. Don’t get advanced in the beginning

There are two additional crucial parts of performing B2B activativation and PLG overall:

Habit Moment

Team-level activation

My advice is not to work on them during the 0-1phase!

The abundance of Activation knowledge out there often leads teams to work on this pretty advanced stuff for which they simply don’t have the capacity, data, and knowledge just yet. This work drags them down the rabbit hole, they get stuck and confused and/or constantly change their activation hypotheses, workflows and metrics.

Instead, focus on getting the user through the Setup and Aha! moments, collecting more data and customer behavior insights, and forming your first hypotheses for the Habit moment.

As for team activation — sometimes it is truly simple, other times it’s way harder.

Do promote team invites and shares by all means. But if your case is closer to “complex” on this spectrum, don’t yet invest a lot of time into building and measuring team activation workflow — instead nail individual users onboarding (especially the first account user).

7. Only focus on your Ideal User now

As we talked about before, in the real world you may have a horizontal product with different personas. And while we can prioritize one - ideal - persona for this new motion, it doesn’t mean we should leave all the other users hanging and unattained (i.e. without proper onboarding).

Pretty fast you’ll understand that creating an activation journey is no easy feat. Hence the advice is to focus only on the Ideal User in this phase and invest in improving their onboarding to better reflect their needs vs. spreading yourself too thin and building onboarding for other user types. Get the main thing right!

When you define the Ideal User through profiling, slingshot them to the right onboarding experience. For others (if they have different needs, goals, and behaviors) you can create a super simple onboarding guide, like a video explanation in a popup, and let them figure out the rest by themselves. You’ll focus on them later in the Growth journey (that’s why they say that Activation work is never over!)

Step 5: Assist with emails

Many teams assume that activation only happens in product and neglect emails.

In reality, your users don’t think about you all the time, they may not understand the product well even if they’re technically activated, and they may not necessarily understand the entire process (it is far from perfect at this point).

So it’s always good to fuel them along the way, nudge, and provide clear next steps via email.

Onboarding emails is a certain form of art, but at this 0-1 stage we do not have a goal to build a perfect campaign. We only want to make sure that we welcome the user and help them move further in case they drop off, and provide clarity about what’s next.

Welcome email

No need to be too fancy here and stuff this email with aspirational marketing promises, case studies, and links to all your support documents.

Include a heartfelt welcome from the founder and clearly outline the next step the user has to take to accomplish their goal in your product. Most likely this CTA will lead the user to the Setup moment. If your product has a complex setup, include a few links for different options, e.g., one leading to developer documentation, another to invite their technical team, or a link to request help from your support team. (NB: only for the first user in this account!)

Additionally, don’t send it from a “No reply” email: provide the ability to reply to the message if they have questions or want to share any feedback.

Aha! Moment nudge

If the user hasn’t reached the Aha! Moment during their first session after the setup is complete, nudge them with an email on their third day.

You don’t have to create a perfect behavior-based email and suggest the exact next step based on what steps they’ve already taken. It’s enough to just tell them that they haven’t completed the main task that would result in a desired outcome, and also remind them of the main value proposition and a few key benefits of your product.

If this doesn’t prompt action, send another nudge on their 7th day.

Activation email

This one is not mandatory at this moment, but you can use this email to congratulate them on their onboarding and provide a few possible next steps for them, especially if your activation journey is scarce with prompts.

This is a perfect opportunity to introduce the user to the collaborative benefits of your product: suggest to invite their teammates and/or share an existing project with them. Don’t forget to outline a few key benefits of collaboration, and include a link to a case study (if you have it) which clearly shows how a similar team has reached success.

Trial expiration email

This one is a very important email that you shouldn’t miss.

Actually, there are two of them:

Send the first email 3 days before their trial expires. Talk about the paid account benefits, share a case study and testimonials from paid clients with their results and ROI.

Make it clear that after the trial expires they won’t be able to use the product.

Don’t forget to include the “Upgrade to paid” CTA in the email that shall lead to the pricing matrix.Send the second email on the day of expiration notifying them about this even. Offer the possibility to talk to Sales about a purchase — this may not be a huge driver but gives a clear direction to users who have the intent but no permission from their company to make a purchase.

For activated an active users, you can offer a trial extension, too.

Make this a two-way street and ask them to share their feedback with you, especially if they have decided not to go with a purchase — it’s a valuable feedback source for startups.

Again, don’t go crazy with personalization and behavioral triggers.

Your main goals are:

Not let the user fall through the many cracks of your imperfect onboarding, and provide additional clarity and support to set them up for success.

Improve awareness of paid account benefits and the process to purchase for higher-intent users.

In my opinion this is the bare minimum of emails you need to create in your sequence.

4. Making It Happen: Your 0-1 PLG Setup

Now that you have a good understanding of what to do, the question is: how to actually pull it off? Where to begin, what resources are needed, and how to set yourself up for success?

The guide below is designed to help operators in the first place. If you’re a founder, you’ll have to assign a responsible person to lead this project (for example, your product leader).

There are 4 main areas that will need your attention.

4.1. Setting the right expectations

In addition to 2.3.3. Alignment, there is one more important thing to be explicit about, regardless of your company’s readiness and your own weight in the organization.

Frame this initiative as an experiment. Here’s why:

a) Everything is a hypothesis now

Your user profile, product value, positioning and messaging, try-before-you-buy and pricing models, activation journey — everything is a hypothesis. Even if you have high conviction about Product-Led Growth viability for your product, your goal is to prove it. And this is what experiments are about.

b) You’ll need runway to learn

You’ll be constantly getting new insights and data about your product and users in the scope of this new work. You’ll not only have to gain new learnings to pave your way forward, but learn to work with this new information iteratively and continuously.

Even if you have great product management practices, this still may be new to a different pace and MO. You need runway to accumulate a critical mass of these new insights and put them to work.

c) This is a new type of work

And it requires new skills, tools, setup and workflows, and even a team. This in itself will take time to figure out and adjust.

To put it bluntly: right now you can’t make concrete promises about timelines (that we tend to underestimate) and impact (that we tend to overestimate).

Even if this is not an entirely foreign work to your team, I recommend min. 4 months to factor in new team dynamics, workflows, time for learning, and inevitable friction and setbacks. If it is — go for 6 months. While team’s velocity is gradually improving today with AI-assisted development, the 0-1 phase is all about gaining clarity and experience.

If you don’t explicitly frame this as an experiment, you may find yourself under constant stress to deliver impossible results, which will be very hard as you don’t have the right foundation to do so just yet.

4.2. Metrics and targets

Don’t reinvent the wheel here — focus on 3 types of KPIs:

Impact KPIs

You started this all to prove that Product-Led Growth is possible for your product, meaning that your product can sell itself. So at this moment, your north star metric should be Trial-to-Paid conversions for your target segment.

Don’t go beyond that. Don’t focus on revenue metrics (MRR/ARR, Self-Serve revenue), churn reduction, or efficiency metrics just yet — they will dilute your focus and may only get you confused.

Make sure that you segment your data by your ICP & Ideal User, and build your reports accordingly. Segmentation may make your numbers look not very impressive, but your goal now is to build and prove your motion, not scale it.

Leading indicators of success

In order to track your progress, build a simple funnel:

Landing page visit → Signup → Aha moment → Trial to paid conversion (self-serve and via sales)

You can extend this funnel to include more steps (e.g., break down the signup and profiling process) for detailed analysis. But for communication and reporting, keep it simple.

Track not only the step conversions per se, but also time to convert. This should give you more insights on improving your Time to Value and activation overall.

Guardrail metrics

You also need to be tracking down-the-line engagement, retention/renewal, and even upsell metrics to see how your experiments influence them.

Be careful not to turn them into your goals at this point. You only want to see correlation between these metrics and your 0-1 PLG work: ideally both should increase. At a minimum, engagement and retention shouldn’t get worse. If they do, this is a signal for you that you’re doing something wrong.

Remember that most of these metrics are lagging, so it may take you a few months before you notice clear correlations. So don’t fixate on them just yet, but don’t forget to keep your hand on the pulse.

Which targets to set

So what numbers should you aim for? Even if you don’t commit to ambitious promises, you still need to understand when you consider your 0-1 project a success and when move on to the next steps.

It’s not an easy question to answer for 3 reasons:

In the beginning you may not even have the entire funnel built out, so you won’t have the baseline for each metric. Doing this will require some time.

Without historical data and deep customer understanding it’s hard to give any reasonable projections for numbers.

Industry benchmarks may not be the best way to assign your targets: not only their relevancy to your business is questionable (benchmarks are generalized and unsegmented), but also getting there will take you many, many more months. It’s better to use them as lightpost goals, not early targets.

Your first goal in this project should be to build out the entire funnel and establish clear and correct baseline for each of your metrics. Depending on where you start, it can take you 2-4 months to get there (you’ll need a month to accumulate this data).

With the baselines in place, you can set yourself some goals. Don’t be a hero and target for a 15% Trial-to-paid conversion rate! Instead, aim for small but consistent MoM improvements, for example +1% each month. Sometimes you’ll achieve more, other times less — these are all learnings that will tell you what works and what doesn’t, and foundations of your growth experimentation engine.

In my experience, it takes 9-12 months to collect the necessary data and learn what works in order to give more or less confident projections of impact for your initiatives.

4.3. Team setup

I recommend creating a separate team for this with single focus on this initiative. This work can’t be a part of the backlog of the team with least projects on their hands — they will inevitably get bogged down in other projects and maintenance

But you also don’t have to hire a new team. In fact, it’s better you don’t: at a minimum you don’t want to spend additional time on new employee onboarding; at a maximum there is a chance that this team will be dismissed after a few months because of failed efforts. Such is life.

Create a temporary “Tiger” team focused on this single project and without any prior obligations, and “hire” your existing employees. Here’s who should be there:

Product Manager

Responsible for planning and running the growth work, doing the analyses, working with teams on solutions, maintaining documentation, working with stakeholders and leadership — the usual stuff. This is always a lot of work, so it should be a full resource.

You want a person who is fluent with data and metrics, a good communicator, and has a bias for action.

Even for a regular PM this shift can be significant, so if you have someone who fits the requirements, has your trust, and is eager to learn, but doesn’t carry the PM title (e.g. Product Marketing, Engineer, Analyst) — you can give them a go.

Engineers

IMO, this team shouldn’t have more than 2 engineers, or they will be slowed down, and it will be harder for the PM to service them.

The thing here is these engineers shouldn’t just be good performers, they should be comfortable working in an entirely different setting: while your core engineers are craftsmen who love solving problems and care about sustainable and beautiful code, your growth engineers should be fast, scrappy, write disposable code, and care about your business.

Designer

You may not even need one in the very beginning if you have a good design and frontend system — your engineers and PM can do the basic work.

Still, I recommend involving a designer early so they can learn the growth context alongside the team. You’ll definitely need one in later stages of your Growth work.

Growth designers need a specific mindset. Look for someone who:

Moves fast and iterates rather than perfecting upfront

Collaborates fluidly without rigid process gates

Is comfortable with experimentation where “right” answers emerge from data, not design authority

In growth work, there’s no time for extensive UX research phases or debates about design ownership. The team needs to work quickly. Everyone owns outcomes together, and solutions come from rapid testing, not upfront certainty.

You won’t need their full resource at this time — aim for 0.5. But help them prioritize Growth work so their availability is immediate, not scheduled for the next sprint in 2 weeks.

Product Analyst

Same applies here: if you have a strong PM and clean self-serve data, you may not need an analyst immediately, but involving one early is smart, as they add depth to insights, optimize data processes, and help the PM stay sharp and make better decisions.

Look for someone who can work at speed in an experimental setting, where analysis serves rapid decision-making rather than comprehensive reports.

Again, 0.5 resource will be enough with clear Growth work prioritization.

Product Marketing Manager

This can be a really good resource to help the team move with user profiles and landing pages, as well as activation emails.

As well, they may be the team’s liaison for the Marketing team to work on campaigns to get traffic for the experiment.

If you don’t have anyone at all for this role right now, you’ll survive, but if you do, make sure the team gets their help.

Act based on your existing resources. Some startups have more, others less. Get creative: a product leader may take on the Growth PM role for now, an engineer can handle mockups, a designer may excel at copy, sometimes a CEO helps with data analysis. Make the best choice from what’s available — don’t aim for perfection or let resource constraints intimidate you.

A note on reporting lines: Keep it simple at this stage. Don’t formalize anything, this whole setup is experimental and you don’t want to introduce unnecessary processes. Leave existing reporting lines as is, but ensure regular communication and alignment between this team and your Growth leader (whoever that is —your CPO, CEO, or the PM leading this initiative).

4.4. Basic operations

New teams inevitably go through a Forming-Storming-Norming cycle. Your job is to make this transition as smooth as possible and help them focus on the work, not the process.

I don’t aim to outline an entire Growth team operating system here, just the critical elements for your Tiger team and pitfalls to avoid.

There are two common failure modes:

The team inherits the operational overhead of their existing product org: standups, sprint planning, retros, grooming sessions, stakeholder reviews, etc.

Or they spend weeks figuring out processes, rituals, optimal sprint duration, handoffs, etc.

None of this matters much at this stage.

This team should optimize for speed, cutting corners and decreasing operational complexity. Your job is to guide them toward this and help remove friction rather than adding rigid structure.

The key principle: start minimal, add only what’s necessary.

Instead of keeping the standard setup and subtracting, start with a clean slate and add only what this specific team absolutely needs. Let them figure this out without too much oversight. Throw them in the water, so to say.

In practice, this means:

Don’t impose specific rituals or delivery systems on them

Actively help them save time on unnecessary meetings

Relieve them of obligations like support, maintenance, and infra work

Let them experiment with their own processes (in my experience, this is inevitable anyway)

Some teams tailor Scrum to their needs. Others don’t have any formal system at all and just continuously plan and release without specific cadence. If it works for the team, it works for you.

One caveat: This lean approach needs protection. Your growth team may have a mandate to skip some processes, but other teams don’t. This creates friction. Your growth team needs urgent support from core teams with packed sprints. Marketing requires formal review processes. Legal needs three weeks notice. You’ll need to actively negotiate exceptions, or your team’s speed advantage disappears.

One last note: if your team can be co-located and meet at least once a week to review work, collaborate and make plans together, do it. This is rare these days, but if you have the opportunity, use it. Things naturally go faster.

4.4.1 Required meetings

To continue the previous message, relieve this team of any former obligations, including meetings. There are only three types of meetings truly necessary for this team.

Daily team syncs

Standard team standup where they discuss progress, blockers, and any incoming news. Not much to add.

Weekly team meetings

Call it whatever you want, just don’t let the name itself limit you — the agenda for this meeting can be fluid and change contextually.

The main thing is that this is the dedicated weekly slot for the team to get together without leadership, review their progress and results, and make plans for the next week.

What the team should discuss:

Progress: Current work, running experiments, and core metrics.

Learnings: From experiments, data, interviews, research, other teams and company updates.

Mini-retro: Pay attention to planning, execution and team dynamics. Just don’t overdo it with processes and turn into a real retro.

Planning: Next week priorities, experiments to launch, work to be done, any collaboration or workshops to be planned.

That’s it. Make it light: they should feel like they’re working in a garage on a new startup (but don’t forget about their responsibility). And pizza always helps.

Two rules: don’t split this meeting into several, and never skip it.

0-1 PLG Program Review (bi-weekly)

Instead of running separate meetings with each leader (CPO, CEO, Marketing, etc.), create a Program for all leadership and the team to meet together, discuss progress and plans, and make decisions.

This is a higher-level meeting that focuses on results, progress and blockers, priorities, tactical changes, issues and critical decisions, not execution details.

Typical agenda:

Metrics & Targets: Results and progress, learnings, questions.

Hypotheses and experiments: Reviews, learnings, necessary adjustments.

Issues and open questions: Discussion that needs input and/or decisions.

Requests: For help and collaboration.

There is no concrete recipe here: the idea is that it’s bi-directional open communication.

Leadership needs to understand what’s happening, whether any plans or expectations should be changed and why, what’s the team’s progress and what blocks or limits them, provide cross-functional input for help, and make any decisions that the team cannot make on their own.

The team needs to be open about their progress and learnings, manage expectations, and proactively ask for help from their sponsors and stakeholders.

As you see, I’m not recommending specific time durations, who exactly should be in the meeting, or specific formats — it’s different for each company’s culture and habits, and changes slightly every week. It’s on you.

The only rule is to make this an open discussion, not a forum for hearings, proceedings and reprimands. But you know this already, don’t you.

4.4.2. Tools & Documentation

Just like with team workflows, don’t overburden this speed-focused team with elaborate tooling.

It’s not about having every possible tool and process, but about removing friction from the core tools and workflows and creating a minimum but working system for the team.

Data tools

As mentioned before, the main thing is that your team has access to up-to-date information and data analysis. It’s okay to start without a self-serve product analytics tool, but sooner or later you’ll have to install one to democratize access to data and shorten the insight loop.

When you do, invest in creating a feasible number of most important dashboards and/or reports (it’s easy to drown in them!) and relevant segments and filters. Remember, clarity and speed is what you’ll need 80% of the time. Don’t make your team spend hours preparing for the Program Review meeting.

Other tools you may consider:

Session replays: Help the team see how users navigate new experiences and what problems they encounter. It’s way faster to spot friction and issues in new launches. Recommend!

A/B testing: Not necessary for a couple of ad-hoc tests (engineers can help you there), but if you find yourself doing this more regularly, get a tool.

CES & customer surveys: Getting qualitative data and feedback from users about your onboarding or other product workflows truly helps.

User onboarding: Such tools give you access to main onboarding techniques like tours, tooltips, checklists, and so on. No need to reinvent the wheel here.

Documentation

The team should be rigorous about one thing: creating their Learnings Library. With time, this documentation becomes priceless.

Document:

Hypotheses and experiments

Learnings from experiments

Results from data analysis & research

Market, customer, and user intelligence

The rest isn’t that important.

When everyone shares the same context and understanding, they don’t need elaborate Jira tickets with step-by-step instructions. They can figure out their own execution because they understand the why behind the work. Knowledge in tickets creates dependencies and slows teams down. Knowledge in shared context creates autonomy and speeds teams up.

Summary

Building Product-Led Growth doesn’t require perfect conditions. It requires clarity.

You don’t need massive teams, pristine data infrastructure, or unlimited budgets. Those are excuses that conceal the real blocker: lack of clarity on what actually matters at your stage.

This guide gave you that clarity:

You now understand:

What Product-Led Growth actually means for B2B (and what it doesn’t)

Whether your product and company are truly ready

The ULTRA framework: a concrete 0-1 roadmap focused on conversions

How to structure your team and operations to move fast without drowning in process

The path forward is simple:

Validate your readiness with the criteria in Section 2

Follow the ULTRA framework step by step

Frame it as an experiment with clear metrics

Start small, learn fast, compound over time

Product-Led Growth is daunting. The challenges are real, the learning curve is steep, and meaningful results take time. But it may well be a worthy investment—one that compounds into your most cost-efficient growth engine.

The decision to start is yours. The roadmap is here.

No more excuses. Just clarity and execution.

Thank you!

You made it to the end!

Thank you for reading and for supporting my work.

These guides take weeks to create. They’re a reflection of almost two decades working with startups, distilled into practical frameworks you can actually use.

If this guide helped you, here’s how you can support:

Share it with a founder or PM who’s wrestling with PLG

Subscribe to get future guides and insights

Like this post to make me smile

Reach out if you have feedback or want to work together (alexandra@growth-zen.com)

Good luck!